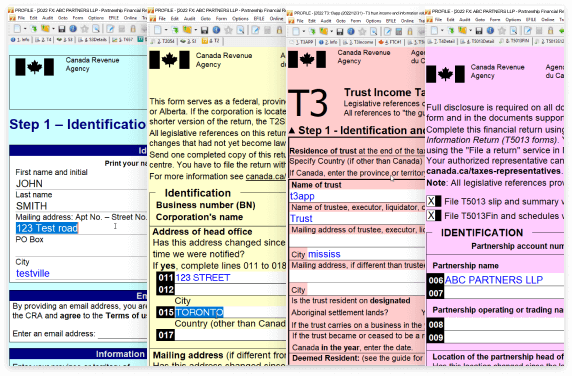

A single install gives you access to all years and modules

You can handle virtually every tax scenario with ProFile

Tax Suites: Federal & Québec

Suites highlights:

- Flexible licensing

- All modules and features for individual, corporate and trust tax returns

- Comprehensive list of forms and worksheets including GST, HST, and QST forms

- Access returns going back a decade with a single install

- Stay error free using the real-time auditor

- Simplify your EFILE process with CRA tools built into ProFile

Need a single return? Get OnePay

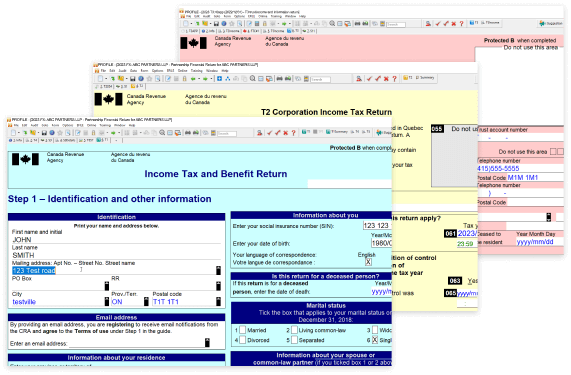

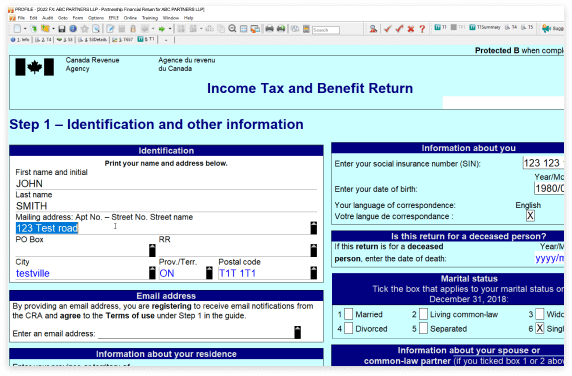

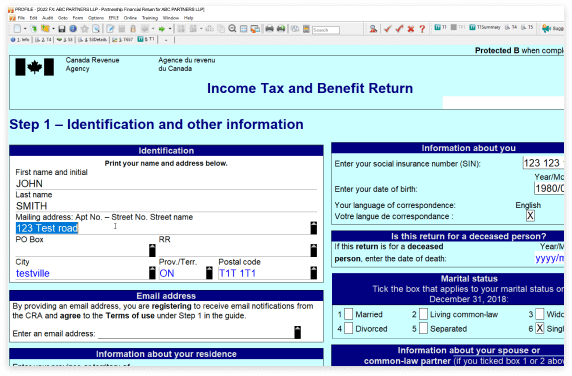

T1 & T1/TP1: Personal

T1 Highlights:

- Flexible licencing

- Access returns going back a decade with a single install

- Simplify your EFILE process with CRA tools built into ProFile

- Comprehensive set of T1 tax forms and worksheets

- EFILE unlimited T1/TP1 returns, individually or multiple in one session

- See the potential impact of changes to a return using variance analysis

Need a single return? Get OnePay

Get 20 T1 returns for just $290 and T1/TP1 for $365 Learn more

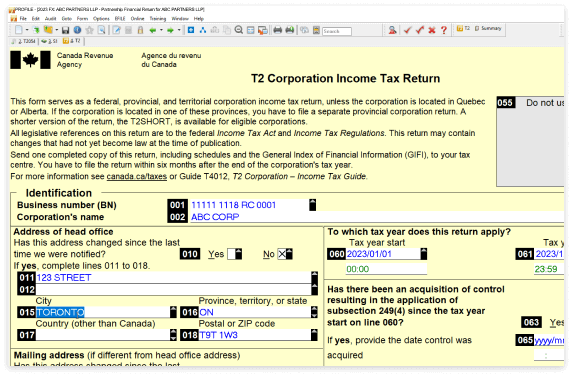

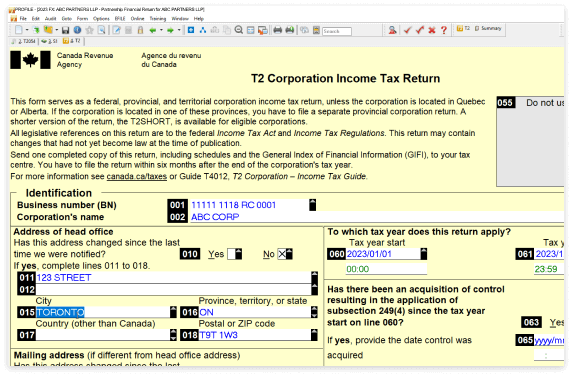

T2/CO-17: Corporate

T2/CO-17 highlights:

- File a group of corporations efficiently by importing information using Corporate Linking

- Import GIFI code data from multiple sources

- EFILE unlimited T2, CO-17 Québec, AT1 Alberta, and many more

- Flexible licencing

- Comprehensive list of T2/CO-17 tax forms

- Access returns going back a decade with a single install

Need a single return? Get OnePay

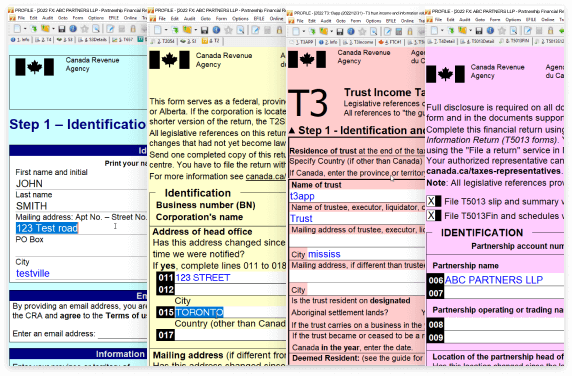

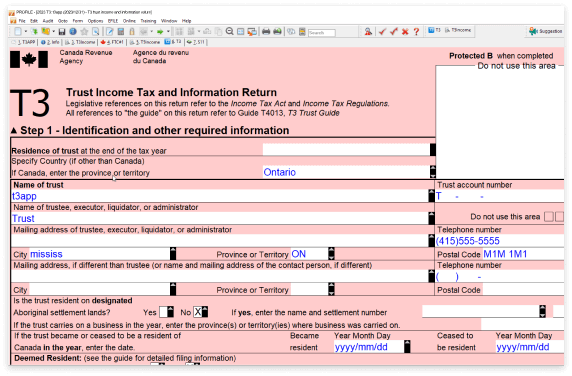

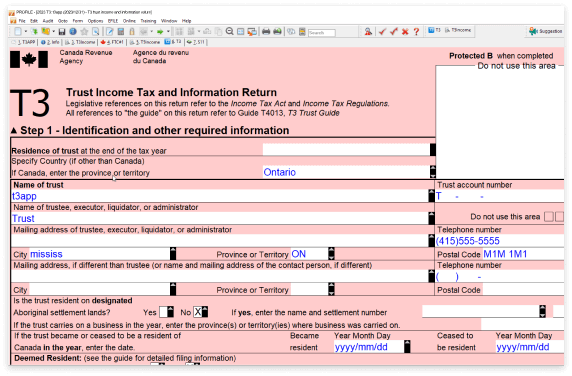

T3/TP-646: Trusts

T3/TP-646 highlights:

- Allocate the correct income and capital to beneficiaries easily with a variety of options

- Flexible licencing

- Comprehensive list of forms: T3 federal, TP-646 Québec, other special trust returns

- EFILE unlimited T3 slip summaries, T3 returns, and RL-16 slips

- Access returns going back a decade with a single install

- See the potential impact of changes to a return using variance analysis

Need a single return? Get OnePay

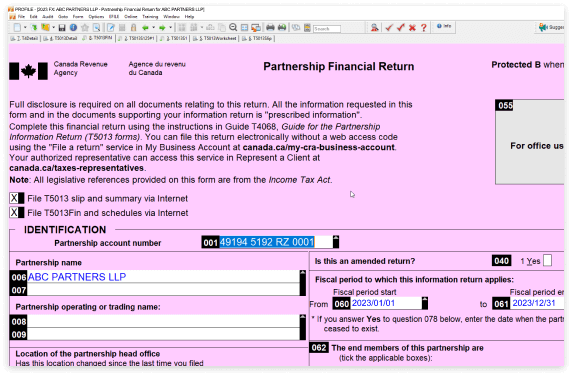

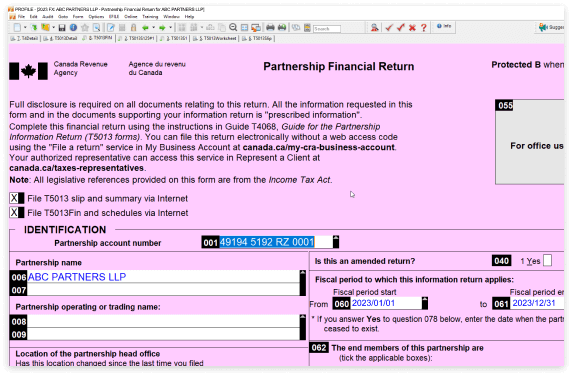

FX: T4/T5 & other forms

T4/T5 highlights:

- Information carries across from ProFile T1, T2/CO-17 & T3 returns

- Flexible licencing

- Unlimited electronic filing of T4, T4A, T5, RL1 and more

- Access returns going back a decade with a single install

- Prepare slips and information returns like T5013, T3010, and TP600

- Comprehensive list of forms and worksheets including GST, HST, and QST forms

Need a single return? Get OnePay

Tax Suites: Federal & Québec

Suites highlights:

- Flexible licensing

- All modules and features for individual, corporate and trust tax returns

- Comprehensive list of forms and worksheets including GST, HST, and QST forms

- Access returns going back a decade with a single install

- Stay error free using the real-time auditor

- Simplify your EFILE process with CRA tools built into ProFile

Need a single return? Get OnePay

T1 & T1/TP1: Personal

T1 Highlights:

- Flexible licencing

- Access returns going back a decade with a single install

- Simplify your EFILE process with CRA tools built into ProFile

- Comprehensive set of T1 tax forms and worksheets

- EFILE unlimited T1/TP1 returns, individually or multiple in one session

- See the potential impact of changes to a return using variance analysis

Need a single return? Get OnePay

Get 20 T1 returns for just $290 and T1/TP1 for $365 Learn more

T2/CO-17: Corporate

T2/CO-17 highlights:

- File a group of corporations efficiently by importing information using Corporate Linking

- Import GIFI code data from multiple sources

- EFILE unlimited T2, CO-17 Québec, AT1 Alberta, and many more

- Flexible licencing

- Comprehensive list of T2/CO-17 tax forms

- Access returns going back a decade with a single install

Need a single return? Get OnePay

T3/TP-646: Trusts

T3/TP-646 highlights:

- Allocate the correct income and capital to beneficiaries easily with a variety of options

- Flexible licencing

- Comprehensive list of forms: T3 federal, TP-646 Québec, other special trust returns

- EFILE unlimited T3 slip summaries, T3 returns, and RL-16 slips

- Access returns going back a decade with a single install

- See the potential impact of changes to a return using variance analysis

Need a single return? Get OnePay

FX: T4/T5 & other forms

T4/T5 highlights:

- Information carries across from ProFile T1, T2/CO-17 & T3 returns

- Flexible licencing

- Unlimited electronic filing of T4, T4A, T5, RL1 and more

- Access returns going back a decade with a single install

- Prepare slips and information returns like T5013, T3010, and TP600

- Comprehensive list of forms and worksheets including GST, HST, and QST forms

Need a single return? Get OnePay

Get returns done accurately and efficiently

Do less data entry and use intuitive reviewing tools you can trust

File a group of corporations easily

T1 Accuracy guarantee

We trust our software so much that we’ll pay the interest charged if there is ever a discrepancy between your client’s filed tax T1/TP1 return and the CRA’s assessed amount.1

CRA tools built into ProFile

Simplify your EFILE process with the latest CRA tools built into ProFile:

- Auto-fill My Return

- ReFILE

- Express Notice of Assessment

- Pre-authorized Debits

Forms for all of Canada

Time savings? I can't even measure that one. That one is fantastic.

Community & support

ProFile has an active online community, extensive training videos, and expert support

Training & webinars

Access extensive training videos, live webinars, and tips & tricks for both beginners and experts:

Community & events

Tap into ProFile’s online community, attend a networking event, and meet the team:

Messaging & support

We’ve got you covered with excellent customer service and support: