Using the T1 Pre-Authorized Debit (PAD) form in ProFile

by Intuit• Updated 8 months ago

Pre-Authorized Debit (PAD) allows tax professionals to submit a payment to the CRA on behalf of their taxpayers who have an amount due on their current-year T1 Personal returns.

This feature saves the taxpayer time over printing a T7DR(A) form and making the payment in-person at their bank.

Note: You must complete a PAD and EFILE it for each taxpayer. If there is a spouse with balance owing, that spouse requires their own PAD form and EFILE effort.

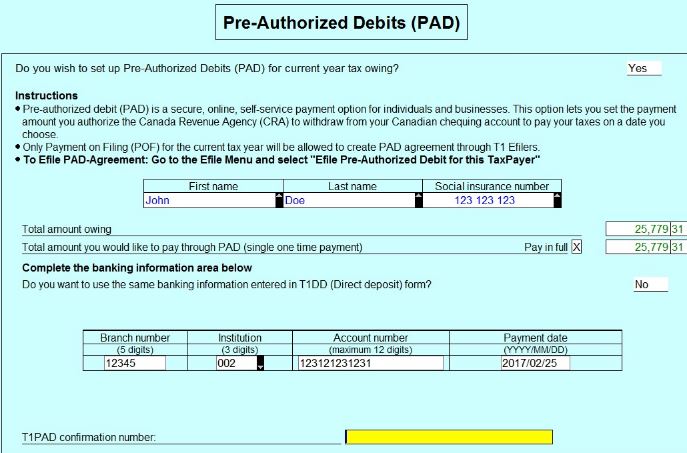

Completing the PAD form

1. Complete the taxpayer's T1 Personal return in ProFile and EFILE.

2. Select Form Explorer from the GoTo drop-down menu in the top toolbar.

3. Search for T1PAD and open the PAD form:

Note: If the taxpayer has completed the T1DD form, you can retrieve their banking information from the T1DD to automatically populate on the PAD.

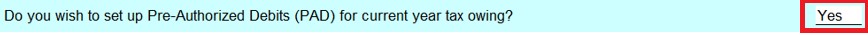

4. Change the Do you wish to set up Pre-Authorized Debits (PAD) for current year tax owing value from No to Yes:

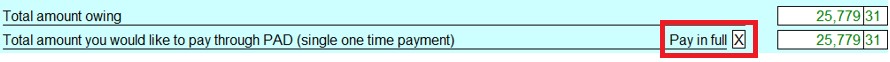

5. Enter the amount to be paid in the Total amount you would like to pay through PAD (single one-time payment) field.

For payment in full, check the Pay in full checkbox:

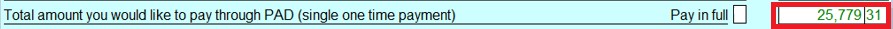

For partial payment, enter the amount in the value field:

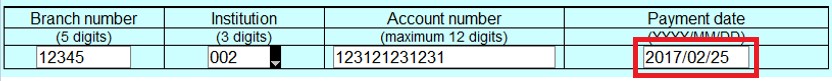

6. Enter a payment date; the date must be between five days and one year in advance of the current date:

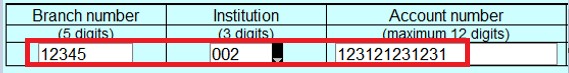

7. Enter details of the bank and account the payment is being made from:

The PAD form is completed.

8. Complete the corresponding T185 form.

Completing the T185 form

1. Select the Form Explorer option from the ProFile GoTo drop-down menu.

2. Search for T185 and open the T185 form.

3. Print the T185 form and acquire a physical signature from the taxpayer in Part B of the form.

4. Print and save the T185 form, and retain a copy for the preparer's records.

5. Provide the taxpayer with a copy of the physical, signed form for their records.

EFILE the PAD form from the T1

1. Return to the taxpayer's already-EFILED T1 form.

2. Select the EFILE Pre-authorized Debit for this taxpayer... option from the EFILE drop-down menu.

The PAD undergoes EFILE. The preparer receives a confirmation number that populates the PAD form (field T1PAD confirmation number) and on the Info page following the EFILE.

More like this

- What's new in ProFileby Intuit

- How to file a bankruptcy return in ProFileby Intuit

- Complete a T1 adjustmentby Intuit

- Error RC530 when EFILEing the T1PAD formby Intuit