Entering boxes 104, 105, 106, 113, 116, 118, 121, 123, 125, and 127 reported on T5013 slip (T1)

by Intuit• Updated 3 months ago

Issue

Some boxes on the T5013 slip (T1 module) aren't required for tax calculations in ProFile and don't display as a result.

This article details how users can enter the information into the boxes if a need arises.

Resolution

Entering boxes 118, 121, 123, 125 and 127

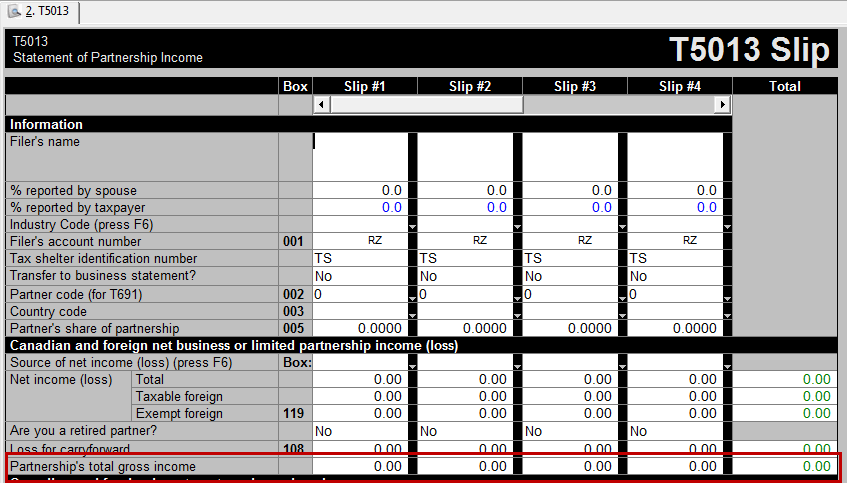

When the T5013 slip is reporting amounts in boxes 118, 121, 123, 125 and 127, this information is entered in the Partnership's total gross income line (line under 108):

Entering Box 104 - Limited partner's business income (loss) (Multi-jurisdictional)

Enter this amount on line 122 of the T1 return. If the partner code is "5", enter this amount on line M on page 3 of Form T2125 - Statement of Business or Professional Activities and report the income on line 135 of your T1 return. The gross amount is in box 118.

Entering Box 105 - Limited partner's at-risk amount

Limited partners only : Enter the amount of the limited partner's at-risk amount (ARA).

Note: Include a note in generic text box 105 in the "Other information" area of the T5013 slip and do not report a financial amount in the generic financial box if:

- the partnership interest is a limited partner's exempt interest and;

- you have entered partner code "3" on line 106 of Schedule 50 indicating a limited partner's exempt interest

Entering Box 106 - Limited partner's adjusted at-risk amount

Limited partners only: enter the limited partner's adjusted at-risk amount (ARA). This is the limited partner's ARA reduced by the limited partner's share of any investment tax credit and any farming losses. A limited partner's share of resource expenses is restricted to the partner's adjusted ARA.

Entering Box 113: Return of capital

This is the capital (including drawings) returned to you from the limited partnership. Use this amount to reduce the Adjusted Cost Base (ACB) of your limited partnership interest.

Box 113 is not a mandatory entry on the T1 return. The return of capital reduces the adjusted cost base (ACB) and should be recorded as an adjustment to the ACB.

Entering Box 116 - Business income (loss) (Multi-jurisdictional)

Enter this amount on line M on page 3 of Form T2125 - Statement of Business or Professional Activities, and report the income on line 135 of the T1 return. The gross amount is in box 118. If you are a partner not actively involved in the partnership, and not otherwise involved in a business or profession similar to that carried on by the partnership, report your share of the net income or loss on line 122 of your T1 return.

Related Articles

A list of boxes can be found on the CRA website atT5013-INST - Statement of partnership income.

A list of instructions for completing boxes can be found on the CRA website at Statement of partnership income - Instructions for Recipient.

For more information about the adjusted ARA, see Boxes 173 to 176 - Resource expenses.

Get in touch with other Accountants

Follow us on Twitter and Like us on Facebook