Filling a T2 Schedule 8 in ProFile

by Intuit• Updated 3 years ago

In order to calculate total capital cost allowance, Schedule 8 gathers its information from two worksheets; the S8Class and the S8Lease.

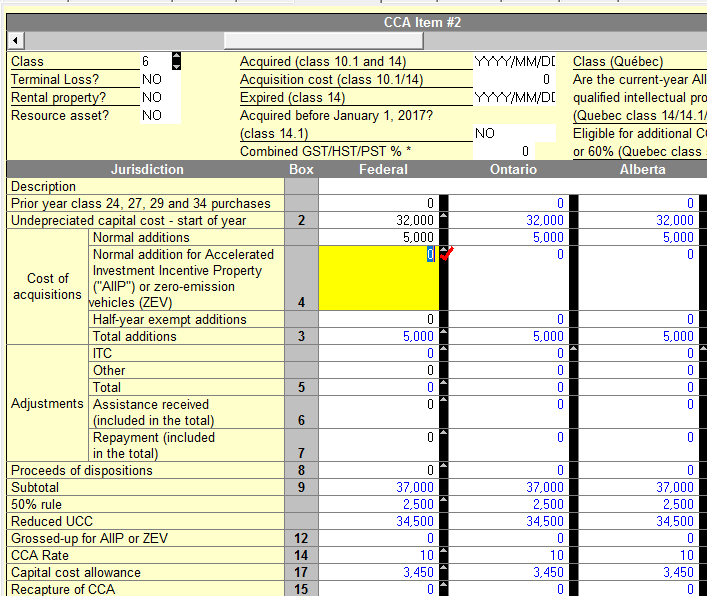

S8Class

All items with the exception of leasehold improvements will be entered on this worksheet. CCA calculates based on entries on undepreciated capital cost at the start of year and additions in the year. Percentage is based on selected Class, except in the case of Class 14 which is based on date acquired and expiry date.

All items, with the exception of leasehold improvements, will be entered on this worksheet. CCA calculates based on entries on undepreciated capital cost at the start of year and additions in the year. Percentage is based on selected Class, except in the case of Class 14 which is based on date acquired and expiry date.

Columns for other provinces are listed only in case you're filing a provincial return to those provinces. If you are not, you may ignore these.

Remember to make entries in the second column at the top if you have a Class 10.1 or Class 14 item.

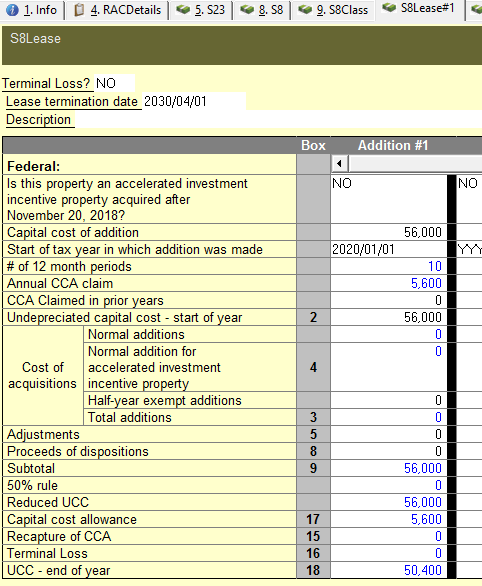

S8Lease

This form is for leasehold improvements. This form does not have a Class drop-down menu, as leasehold improvements are always Class 13. Fields of The Start of the tax year in which addition was made, Lease termination date, as well as Capital cost of addition and Undepreciated capital cost - start of year should all be filled.

After filling S8Class, and if needed, S8Lease, calculations on those forms should go to the Schedule 8.

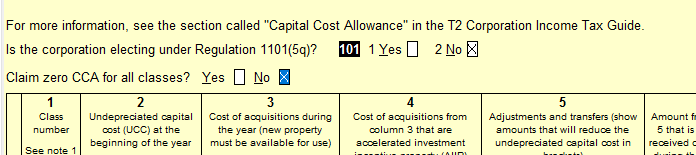

Tip: If you don't wish to claim CCA and it is available to be claimed, make sure Claim zero CCA for all classes is set to No.