Manitoba capital tax return MCT1

by Intuit• Updated 2 years ago

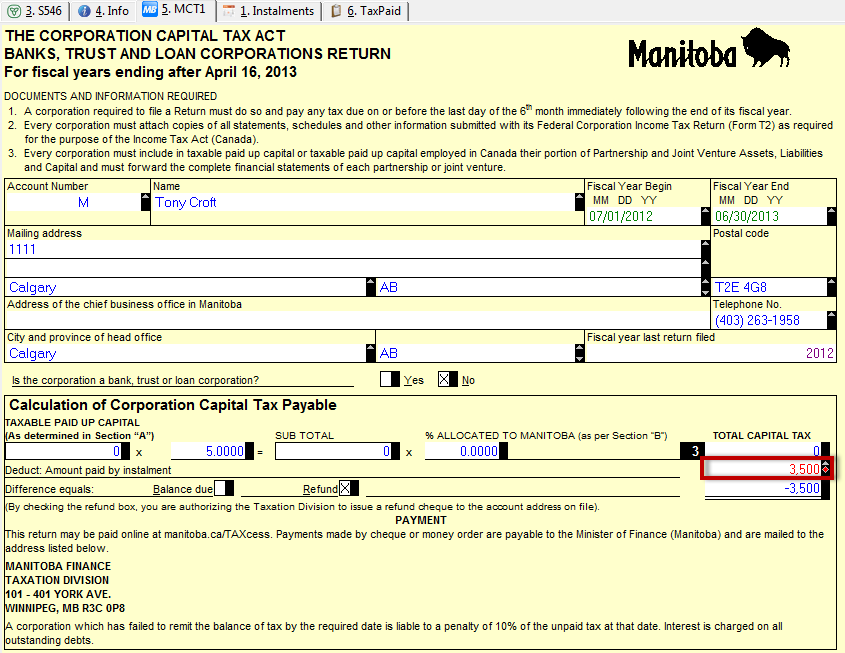

There is a miscalculation on the MCT1 (Capital Tax) form. This is creating a large refund when there is nothing selected under Type of corporation > Special corporation status on the Corporate information page.

1. Ensure ProFile is updated to the latest version by going to Online > Check for Updates...

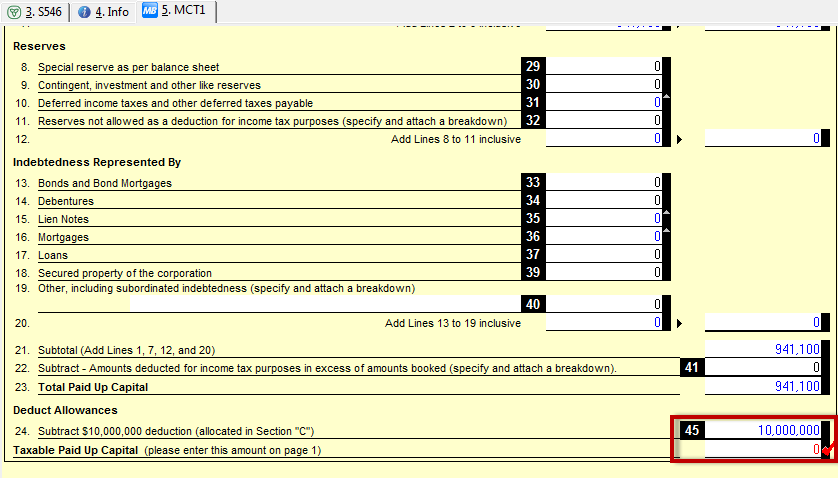

2. If the filing corporation is not a Special Corporation, the workaround is to override the amount in MCT1, Section A, Taxable Paid Up Capital (the line below line 45) to zero.

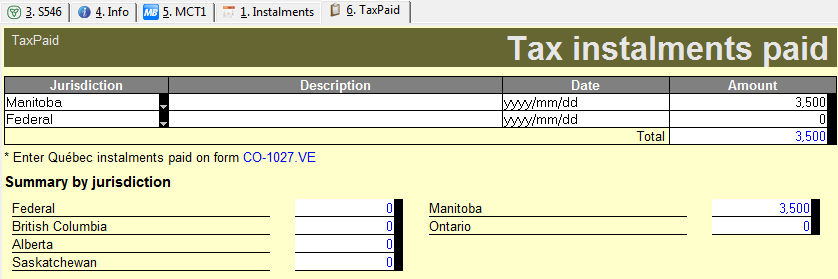

There is another override that may be required if the filing corporation does have a Special Corporation status of a Trust and Loan Corporation, Bank or Authorized Foreign Bank on the Info page. The installments paid are not flowing from the Tax Paid form to the MCT1. The workaround is to override the Instalment payments made on MCT1 (the line below line 3) to the correct amount shown in the Tax Paid form.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Profile users.