Change dates on the Business Auto form

by Intuit• Updated 8 months ago

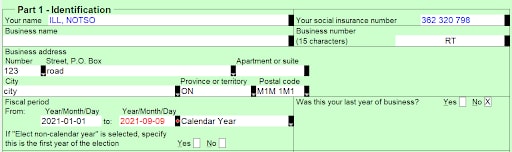

Dates for the fiscal period at the top of the Business Auto worksheet are locked with the text in green. If a change must be made, it can be made on the corresponding business statement.

Note: Fiscal period on the Business Auto worksheet is for the fiscal period of the business statement, and not the period the vehicle was used in the tax year.

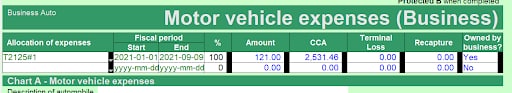

Entries related to purchases, leases, and resales of vehicles are dealt with in Charts B, C, and D of the Business Auto sheet. The Business Auto worksheet is an Intuit worksheet and does not get transmitted to CRA during EFILE. It is used to calculate capital cost allowance and expenses related to automobiles on other business statements.