Claim CCA for Class 14 Assets on the T2 module

by Intuit• Updated 2 years ago

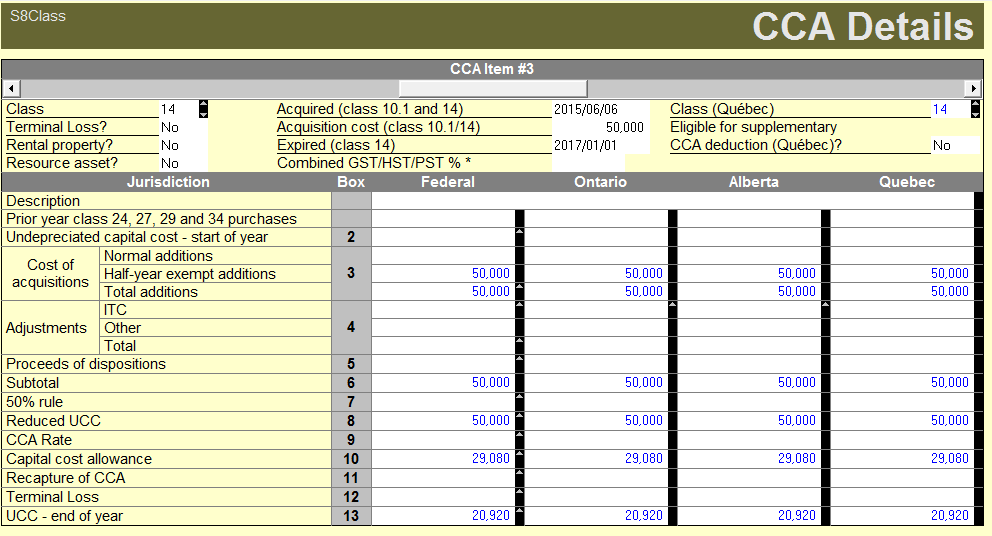

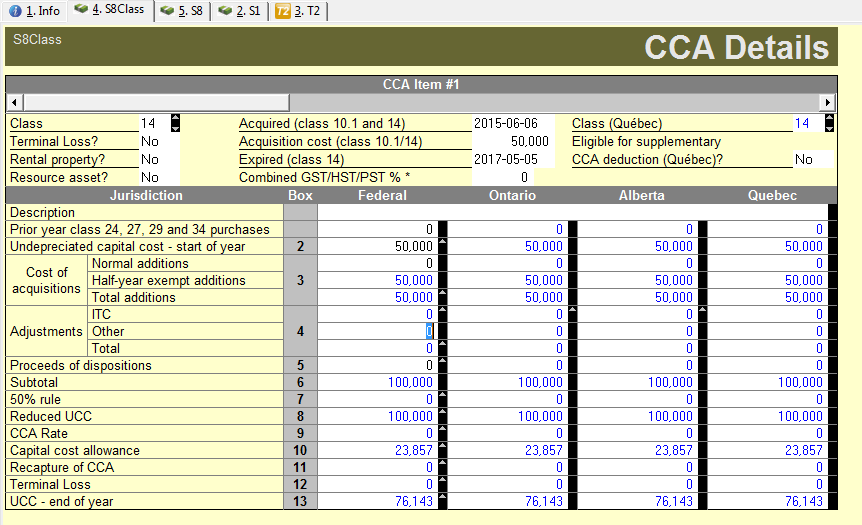

Class 14 assets can be shown on schedule 8 in Intuit Profile. Four entries are required on the CCA Details:

- Class - 14

- Acquired (class 10.1 and 14) - date asset was acquired

- Acquisition cost (class 10.1/14) - original asset cost

- Expired (class 14) - expiry date for asset

If entering an asset purchased in a previous year, Undepreciated capital cost - start of year is required.

More like this

- Filling a T2 Schedule 8 in ProFileby Intuit

- T2 S8 Class 13 - Change CCA Rate of the applicable column to N/Aby Intuit

- Info about accelerated CCA calculations/Accelerated Investment Incentive (AIIP).by Intuit

- Reconciliation of net book value and undepreciated capital cost in the T2 module in ProFileby Intuit