What was fixed in recent ProFile releases

by Intuit• Updated 3 months ago

Heads up! Microsoft is ending support for Windows 10 on October 14, 2025. This means no more free technical assistance or security fixes. To keep your system secure and your ProFile experience optimal, we recommend upgrading to Windows 11.

The following issues were addressed in recent ProFile releases:

Table of contents:

Amount of credit reduction on Line 431 of TP1 is incorrect

Issue

If your spouse is transferring an amount of credit on line 431 of your TP1 and is also transferring to their father or mother an amount as a child 18 or over enrolled in post-secondary studies, your amount on line 431 is being reduced by 15% of this amount transferred to their father or mother (line 20 of your spouse’s Schedule S).

This rate should be 14%.

Workaround

Under this scenario, deduct 14% of the amount transferred to their father or mother on line 20 of your spouse’s Schedule S from the amount transferred on your spouse’s TP1 line 430 and enter the result on line 431 of your TP1 return.

T3010 doesn't calculate

Issue

No field is being carried forward to or calculated on the T3010 (Registered Charity Information Return) in the 2022 FX/Q module in the 2022.5.0 version of ProFile.

Workaround

Call ProFile Customer Success for assistance with a workaround for this issue.

Exemption calculates tax unexpectedly on UHT2900

Issue

UHT2900 calculates the Underused housing tax owing in Part 8 when an exemption is claimed on the form. When an exemption is selected for Part 4 line 405, Part 5 line 505, or Part 6 line 605, tax owing should be calculated as 0 (zero).

Workaround

If YES is selected for Part 4 line 405, Part 5 line 505, or Part 6 line 605, an exemption applies. Override Part 8 Line 8A to 0.

Some FX/Q files with T4 slips are experiencing slowness

Issue

Certain FX/Q files with T4 slips/return are experiencing slowness.

As a result, data in the file is corrupted.

Workaround #1

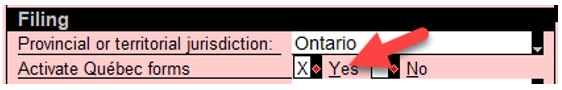

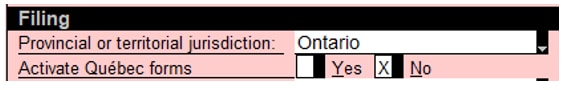

- Navigate to the INFO form.

- Select Yes in the Activate Quebec Forms option under the Filing section.

- Select F2 to remove the override.

The Activate Quebec forms option is now set as No again.

The slowness issue should be resolved.

Workaround #2

This workaround requires the user’s awareness as to where the data is entered in the corrupted FX/Q T4 files.

- Open the corrupted FX/Q T4 file.

- Create a new blank FX/Q return at the same time.

- Select Tile horizontally or Tile vertically (available in versions 2022.3.0 and later) from the Windows menu or select the shortcut to view both returns side-by-side.

- Open the INFO form in the corrupted FX/Q T4 file.

- Select Copy Form from the Edit menu.

- Navigate to the new FX/Q T4 file and open the INFO form.

- Select Paste Form from the Edit menu.

T2125 comparative percentage of partner’s share displays 1000 times larger when carrying forward from TaxCycle

The T2125 comparative percentage of partner’s share displays 1000 times larger on the sheet than it should when carrying forward from TaxCycle.

Workaround

Remove the prior year data from the sheet and enter the prior year data manually.

Resolution

This issue was resolved in a recent ProFile release.

T2 Line 565 Additional tax on banks and life insurers is calculated unexpectedly

Issue

Additional tax on banks and life insurers from Schedule 68 Is calculated unexpectedly and flows to T2 Line 565 incorrectly. This issue affects corporations other than banks and life insurers with tax years ending on or after April 7, 2022.

Workaround

Override Schedule 68 Line 250 to a value of 0 (zero) if the corporation is not a bank or life insurer. Save and re-open the T2 file.

Resolution

This issue was fixed with a ProFile patch release.

T2 2019-2022 module doesn't carry forward S8/S8Class data to 2020-2023 module

When carrying forward a T2 2019-2022 module ProFile file to T2 2020-2023 module, no data is carried forward to S8/S8Class in the new file.

Workaround

- Make a copy of the T2 2019-2022 module source file for carry forward purpose only.

- Open the new file.

- Select the option Properties under the File drop-down menu.

- Change the client status, EFILE status, AT1 Status, and CO-17 Status to 0.Unknown.

- Save and close the file.

- Re-open the file.

- Select Yes when ProFile prompts the question Do you wish to load the file in the 2020-2023 module?.

- Right-click on a form and select the option Carryforward from the menu.

Resolution

This issue was fixed in ProFile release 2022.2.0.

More like this