Internet file slips in the FX module in ProFile

by Intuit• Updated 1 month ago

This article explains how to internet file various slips in the FX module.

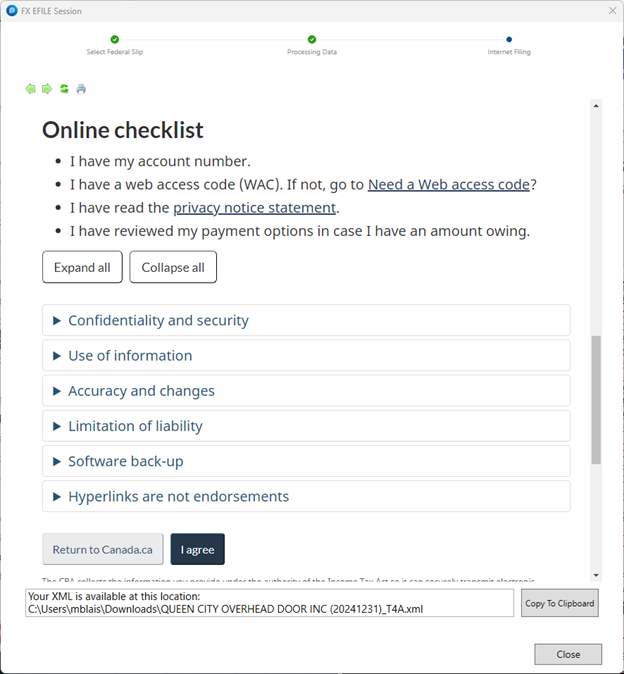

Note: Ensure that you print the transmission confirmation from the CRA page at the end of the process. ProFile doesn't keep a record or report of slips that have been transmitted.

Review this article for Quebec slips.

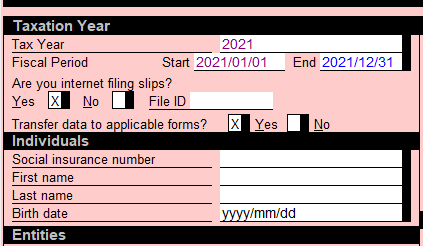

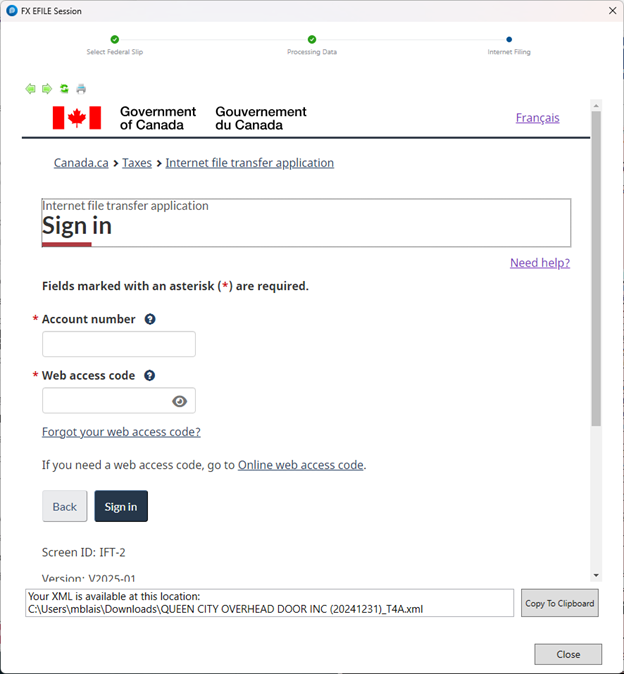

Setting up transmission credentials

Before you start, make sure your filing credentials are entered. A transmitter number is no longer needed, but you'll need a Rep ID, trust number, business number, or nonresident account number. See our article on entering filing credentials for FX or T3.

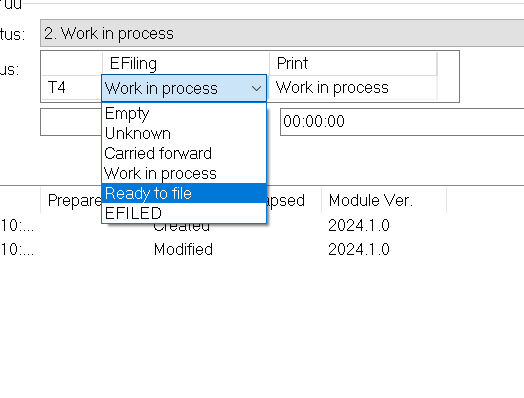

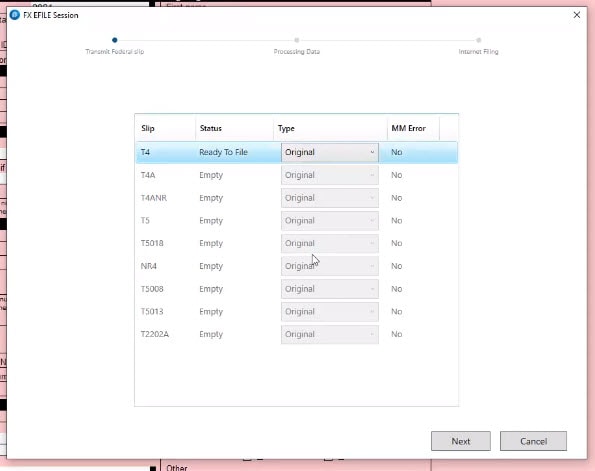

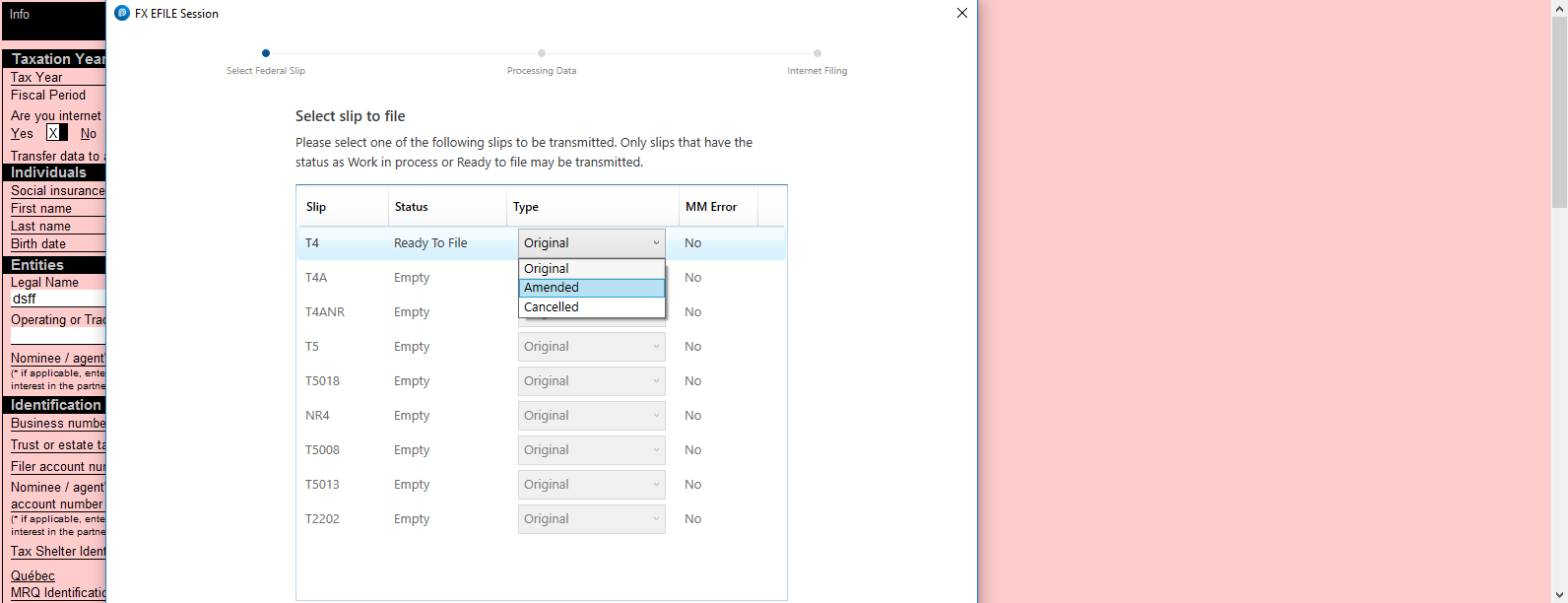

Filing slips

Select the type of filing you are undertaking:

Note: Only current year slip filing is supported in Profile at this time.

You'll receive a confirmation. We recommend that you print it.

Changing the location of all XML generated files

- Select Options... from the EFILE dropdown menu. The Electronic Filing Options window will display.

- Select the T3/FX option.

The current location for XML files is listed under the XML Directory section:

- Select Browse and navigate to the new location for XML file storage.

- Select OK.

The new location is saved.

More like this