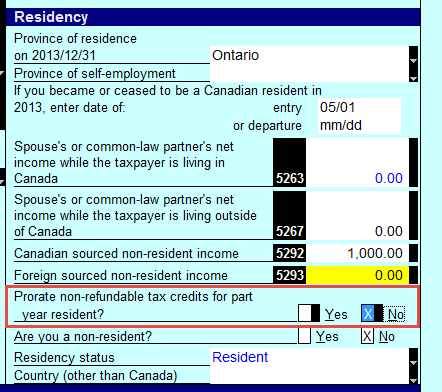

Proration calculations for a non-resident are not prorating properly

by Intuit• Updated 1 year ago

How ProFile calculates non-refundable tax credits for immigrants to Canada

Via the 2013 CRA manual (page 75, Appendix L for Proration of credit for new comers):

"In order for an immigrant to be allowed full non-refundable tax credits in the year of immigration, the taxpayer must meet the 90% rule for the period of non-residency. A taxpayer will meet the 90% rule if the Canadian-source income reported by the taxpayer for the part of the year that they were not a resident of Canada is 90% or more of their net world income for that part of the year. A taxpayer will also meet the 90% rule if they had no foreign or Canadian-source income in the period that they were not a resident of Canada. If a taxpayer does not meet the 90% rule, the non-refundable tax credits will be prorated based on the immigration date."

For example, if a taxpayer came to Canada in April, had income from a job, but had no income in the first 3 months of the year prior to coming to Canada, they would be entitled to full non-refundable credits.

Based on amounts entered on line 5293 and 5292 as well as income reported on tax return, Profile automatically selected Yes or No for Proration: