Claim rent for students on ProFile ON-BEN

by Intuit• Updated 3 years ago

Ontario allows a rent claim for Ontario residents. The entries are made on ProFile ON-BEN, and the estimated calculation of any eligible claim can be seen on the GST form in ProFile.

Entries can be made in Part B of the ON-BEN for rent or property tax paid except where a residence was a designated Ontario university, college, or private school residence.

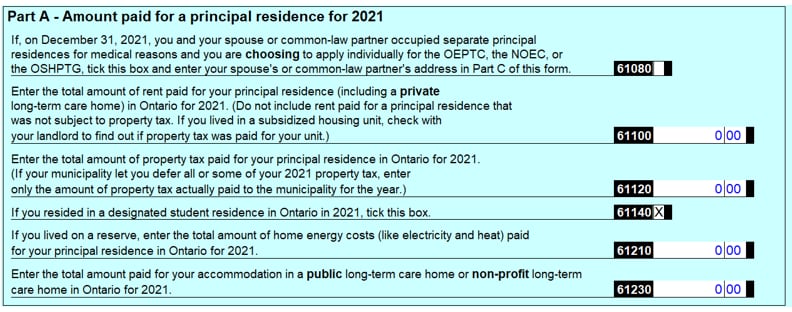

In this case, check box 61140 on the ON-BEN in addition to checking box 61020 and make any other applicable entries:

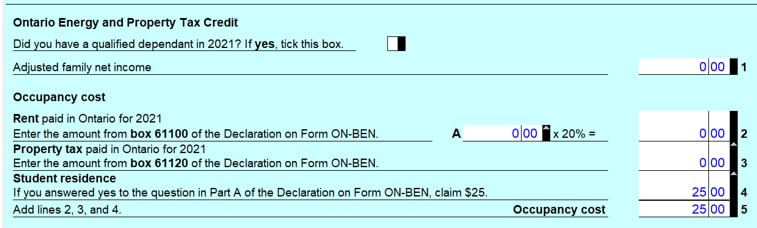

ProFile then makes the $25.00 entry as required by the CRA on the GST screen:

This follows the CRA guidance:

If you lived in a designated Ontario university, college, or private school residence, place a checkmark beside box 61140. Do not enter any amounts paid for the residence beside box 61100. The CRA will use $25 when calculating the property tax component of the OEPTC for the part of the year that you lived in residence.

The CRA reference can be found here.