How to report RRIF re-contribution in ProFile

by Intuit• Updated 2 years ago

What is RRIF re-contribution?

For 2015 and later years, Budget 2015 introduces a reduction to the minimum amount that must be withdrawn from a RRIF for a holder who is 71 to 94 years old. Individuals who have withdrawn more than the reduced 2015 minimum amount will be permitted to re contribute the excess (up to the amount of the reduction in the minimum withdrawal amount set out in Budget 2015) to their RRIFs.

Individuals can re-contribute amounts before March 1, 2016. The re-contribution will be deductible when calculating the holder's income for the 2015 tax year.

For more information, see Minimum withdrawal factors for registered retirement income funds.

How to claim this deduction in ProFile

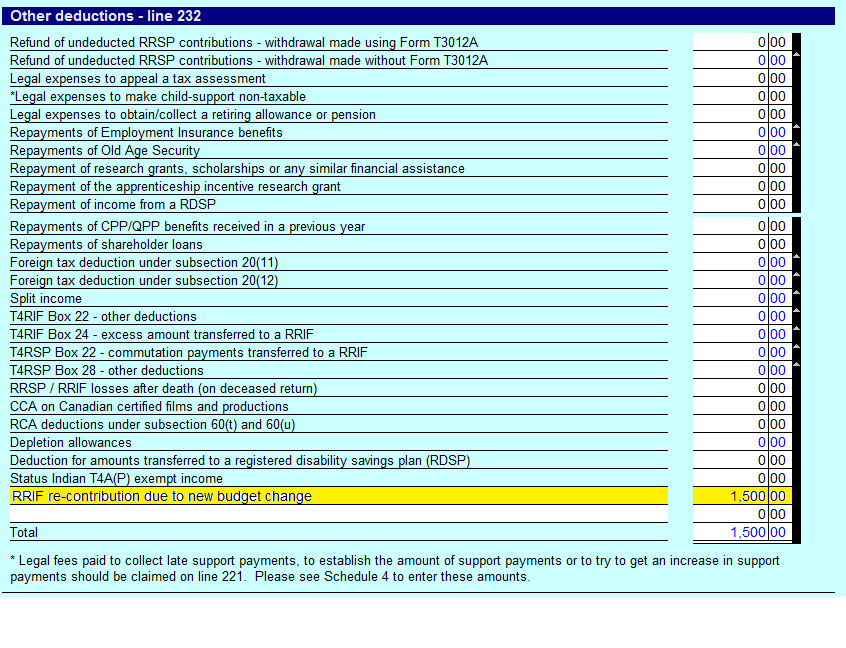

1. Open the form OtherDeduct and go to the Other deductions section.

2. Enter the description in the open cell under the section Other Deductions - line 232.

More like this