T1 module does not have a form related to NR4 (Non-Resident) Income

by Intuit• Updated 1 year ago

There are occasions when income reported on an NR4 slip needs to be reported on T1:

- The preparer must determine if a T1 is required

- The preparer must determine what T1 to file

- The preparer must determine how to report the income

- ProFile T1 allows preparation of any required resident or non-resident return

How to enter income from an NR4 slip in ProFile

An example is below, but here's a video of the process (includes sound).

Solution example

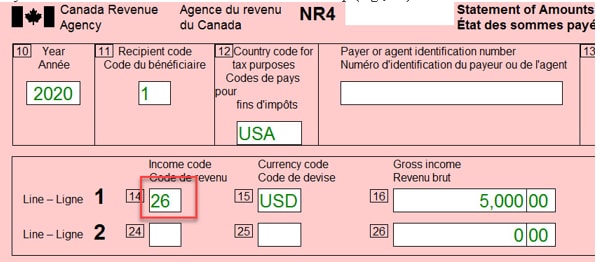

1. Identify the income code number in box 14 of the NR4 slip (for example, 26).

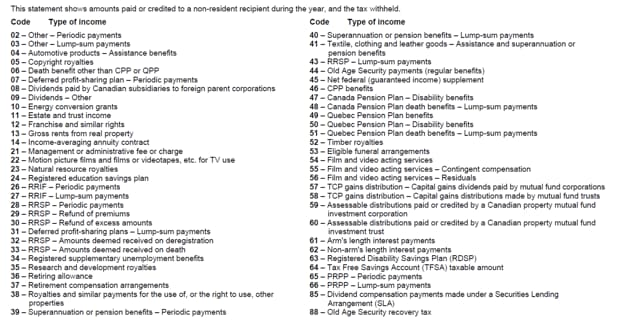

2. Review the description associating the NR4 slip to a corresponding T-slip on the T1 module.

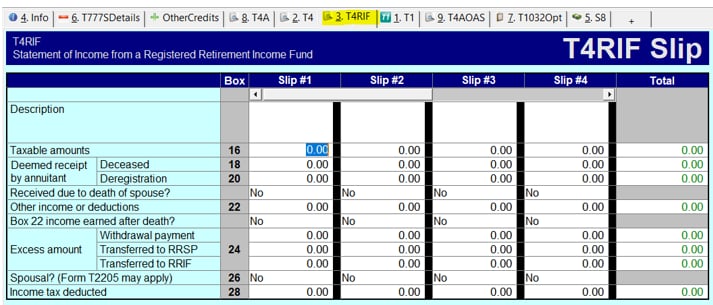

3. Match the income code from box 14 to the corresponding form in ProFile.

For example, Box 14 shows 26 and the description has income code 26 as RRIF – Periodic Payments. Therefore, the corresponding form would be T4RIF.

References

More like this