Optimize pension-splitting in ProFile

by Intuit• Updated 3 months ago

Optimize the pension-split amount for a client

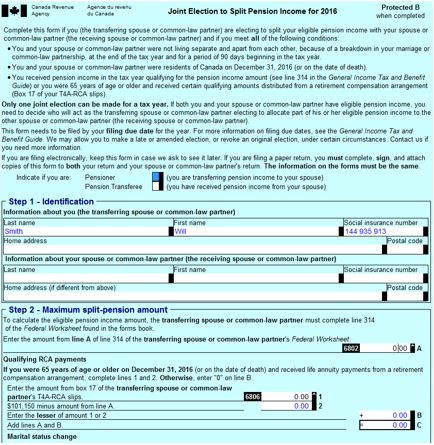

- 1. Open Form T1032 - Joint Election to Split Pension Income for 20[YY] in the return of the person receiving the pension:

- Select the box to indicate the person is the Pensioner.

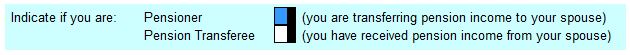

- Locate section Step 3 - Elected split-pension amount.

- Select the Split-Pension Income link. The T1032Opt Optimize - Split-pension income form opens.

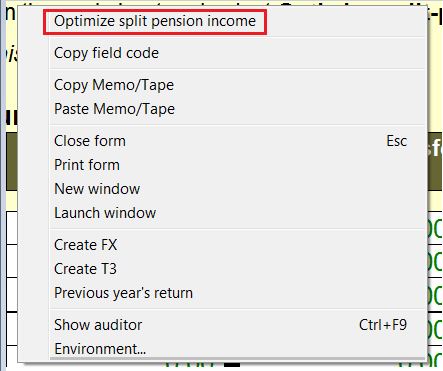

- Right-click anywhere on the T1032Opt form. The following menu displays:

- Select the Optimize split pension income option.

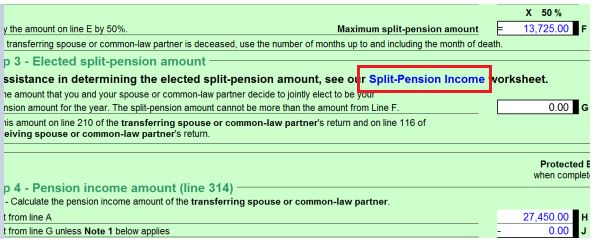

Note: The T1032Opt form shows the suggested split-pension information. A graph shows how different pension income splits affect your combined refund and balance due.

- Enter the amount desired in Field G. The T1032 form populates based on the split-income selection.

Use the scenarios in the Calculator section

- Select anywhere in the Elected split-pension amount box under Scenario 1.

- Enter the amount of pension income to be split.

- Select OK

.

The calculator displays the Total Payable and Balance Owing for each individual, as well as combined totals for the couple.

More like this