T1 pension splitting and how to split foreign pension and tax on the FTC form in ProFile

by Intuit• Updated 8 months ago

In this example, the pensioner has $6,478.50 in foreign pension and is splitting it with a spouse: $3,239.25.

There was foreign tax paid in the amount $647.85. Therefore, the amount of foreign tax to be entered on the pension transferee is $3,239.25/$6,478.50 x 647.85 = $323.92.

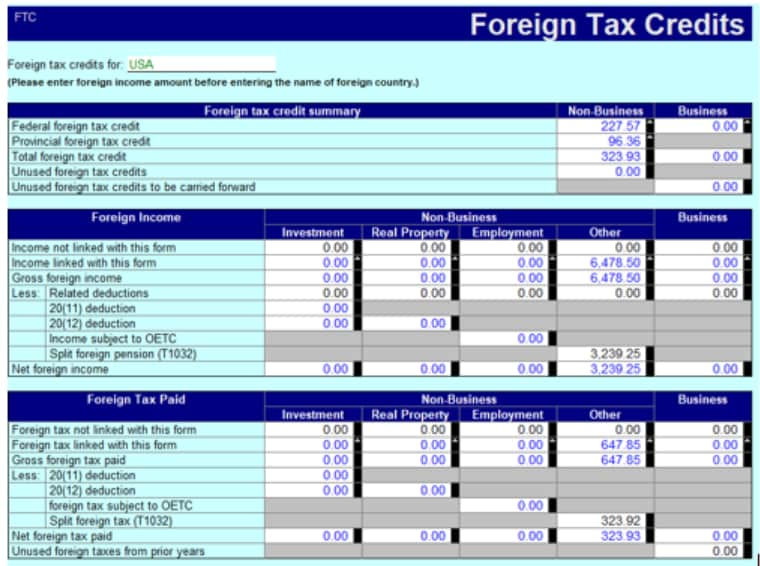

The pensioner enters the pension amount in the following fields on the FTC form:

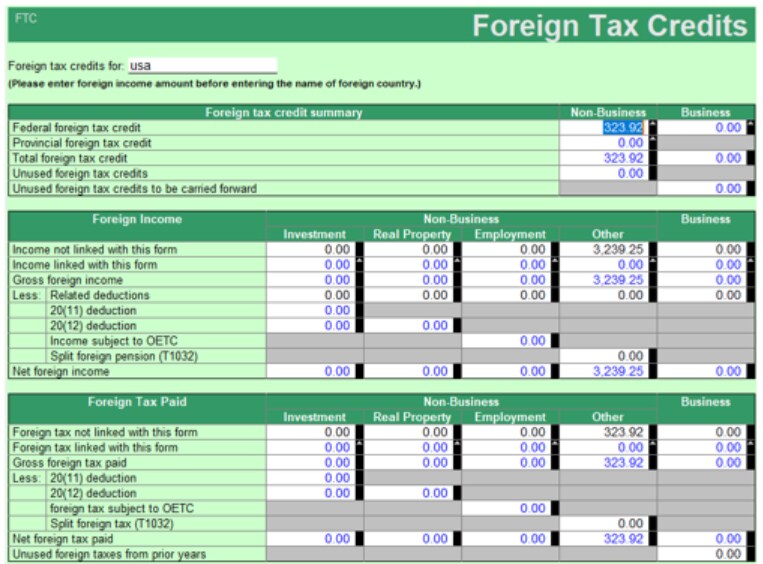

The spouse (transferee) enters the amounts in the following fields on the FTC form:

More like this