Transmitting discounted returns with refunds of less than $100

by Intuit• Updated 2 years ago

ProFile offers a diagnostic for discounted returns that have a balance of less than $100. Since discounters are limited to 15% total fees on refunds of $300 or less, the profit margin may be an issue when the refund is relatively low.

ProFile does not prevent you from filing discounted returns, but there is an optional setting that will prevent filing if there are any unresolved ProFile warnings. This diagnostic setting is designed to help you catch possible problems before you transmit files.

Follow these steps so that warnings do not prevent you from filing discounted returns with refunds of less than $100.:

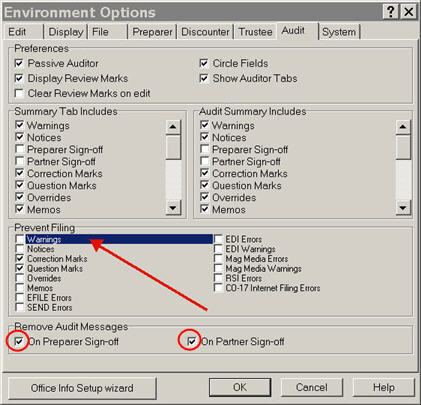

- Click on Options > Environment.

- Click the Audit tab.

- In the Prevent Filing section, deselect Warnings.

Another solution is to use the preparer or partner sign off (checkmark or hooked checkmark on the toolbar) to indicate that you have reviewed the diagnostic.

Activate this feature

- Click on Options > Environment.

- Click on the Audit tab.

- In the Remove Audit Messages section, ensure that the On Preparer Sign-off and/or On Partner Sign-off checkbox(es) are selected.

The cursor will become an arrow with a checkmark attached to it. When you click on a field, a red checkmark will display to indicate that this field has been reviewed and that you wish to override any warning associated with this field.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Profile users.

More like this

- Capital Cost Allowance for motor vehiclesby Intuit

- "Not authorized to transmit the income tax file" error when trying to NETFILE a TP1 return in ProFileby Intuit

- ProFile T2 Schedules 100 125 and 141 for inactive corporationsby Intuit

- Out of memory error when making over 100 entries on S6 in the T2 module in ProFileby Intuit