2018 T3 trust return calculating an incorrect Ontario basic additional tax

by Intuit• Updated 2 years ago

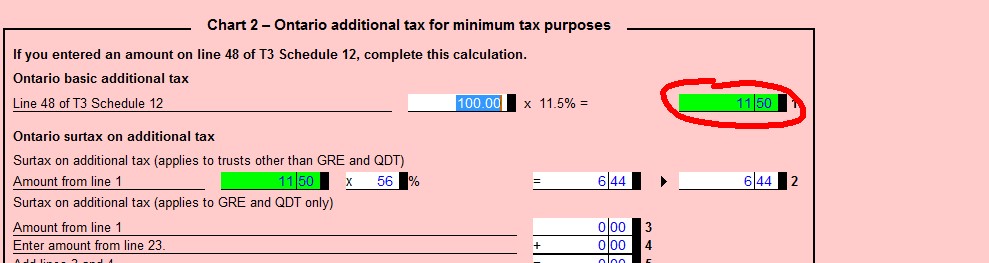

The 2018 T3 trust return is calculating an incorrect Ontario basic additional tax for minimum tax purposes due to an incorrect percentage in Chart 2 of the T3 Ontario form. It is calculating 11.5% of line 48 of Schedule 12 when it should be 33.67%.

Example of the incorrect calculation:

Workaround

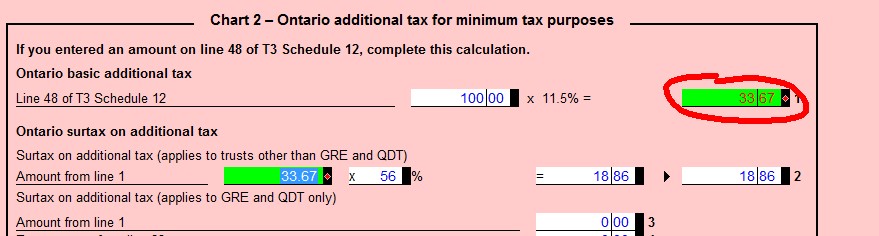

Manually override the calculation at line 1 of Chart 2 with the amount calculated by multiplying the value at Line 48 of the form T3 Schedule 12, if applicable, by 33.67% instead of 11.5%.

Example:

More like this

- EFILE other returns in the T3 moduleby Intuit

- File a T3 return and T3 slips in ProFIleby Intuit

- Create a T3 return in ProFileby Intuit

- Data entry and flow in ProFile T3by Intuit