Enter Quebec tax deducted for a non-resident of Quebec

by Intuit• Updated 2 years ago

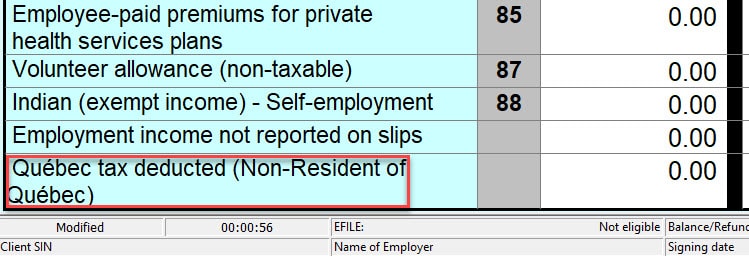

The ProFile T4 worksheet contains a space at the bottom to enter taxes deducted on Box E of an RL-1 slip if the recipient is a resident of a province other than Quebec on December 31.

Entries will offset Quebec tax deducted against taxes owing to the province of residence. Note that this should be used for employment income only.

If you are not sure if you should be filing a TP1 return for a resident of a province other than Quebec, please review this Revenu Québec article.

Note: Make sure what's selected in Box 10 on the T4 worksheet matches what's on the slip given to the taxpayer.