Foreign Tax Credit Form in ProFile: Review and frequently asked questions.

by Intuit• Updated 3 months ago

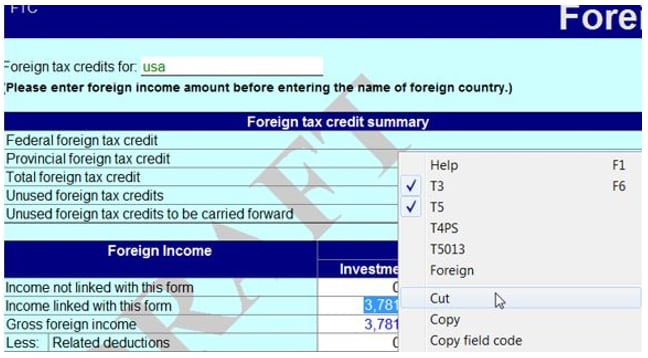

Right-click on the form to see where these amounts come from.

Understanding the flow

- The user enters Slips into ProFile.

- The user navigates to the FTC form and enters the country.

- The user reviews the CRA FTC forms (T2209/T2036); they are already automatically populated, based on the FTC form in step 2 above.

- The credit flows automatically to the S1 (federal)/[provincial]428 form).

Frequently asked questions

Why aren't the amounts on the FTC form calculating?

Check the FTC form and slip and ensure that the country is selected.

Why doesn't my T2209 form match the FTC form?

As there can be multiple FTC forms, there can also be multiple T2209 forms. Review the T2209S form, which is the summary of all T2209 forms.

I pay taxes in the US. Am I being taxed twice?

Once you've filled out the foreign income, foreign taxes paid, and country sections on the FTC form, you’ll see your federal and provincial foreign tax credit amounts calculated using the T2209 and T2036 forms.

Recommended: Review the CRA’s support articles to learn more about this credit and how it works:

What is this warning regarding the 20(11) deduction?

Tax treaties between Canada and other countries vary, and ProFile doesn't track them. ProFile calculates 15%, but you need to review Subsection 20(11) and tax treaties for the country entered. If everything looks correct, sign off on the message or adjust the amount.

Review the CRA’s support article to learn more about this credit and how it works.

CRA resources

Review the CRA’s support articles to learn more about tax-related questions:

More like this