Claiming labour-sponsored tax credits on a TP1

by Intuit• Updated 1 year ago

Labour-sponsored credits are calculated in ProFile using the RL-10 worksheet. For more information, review Revenue Quebec’s guide regarding the credit.

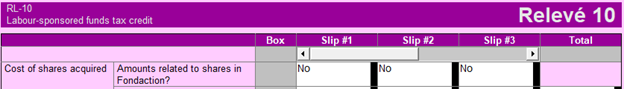

Entering amounts of the RL-10

Enter the values on the taxpayer's RL-10 slip onto the RL-10 slip worksheet.

To enter an amount in Box G, you'll need to say Yes to the question “Amounts related to shares in Fondaction?” On the worksheet, this is set to No by default.

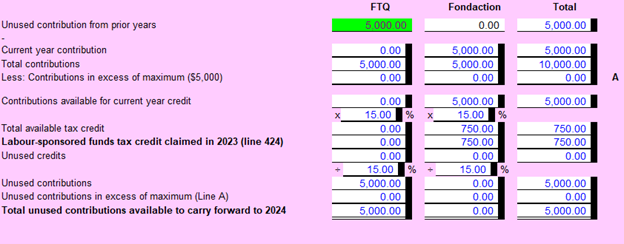

To enter any prior years unused contributions, enter it into the Unused contributions from prior years field. Any contributions from this year and previous years that are unused carry forward to next year.

The Credit appears on line 424 of the TP1 and 41400 of the T1.

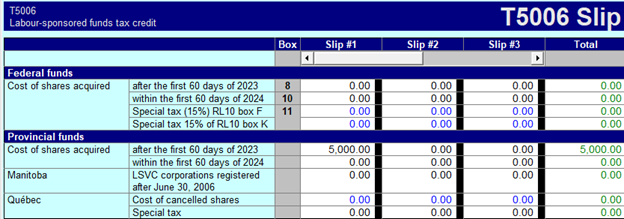

Amounts entered on the RL-10 worksheet will also appear on the T5006 worksheet in the Provincial funds section.

More like this

- 2017 personal income tax changesby Intuit

- 2023 TP1 tax updatesby Intuit

- Claim tuition credits in ProFileby Intuit

- How to refile, amend or adjust TP1 returnsby Intuit