Completing the TP1D in ProFile

by Intuit• Updated 4 months ago

Here's how to fill the TP1D form as part of the TP1 return in ProFile.

Fill the RL-31 worksheet

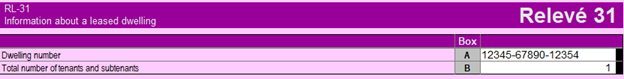

Enter your customer's RL-31 slip information. The dwelling number is 15 characters and can be letters or numbers. A coupled return will require 2 to be entered in Box B or a netfile error may occur.

Fill the TP1D

- Open the TP1D on the return of the spouse claiming the Solidarity credit.

- Select the box marking that taxpayer as the one claiming the Solidarity credit.

- If the dwelling is owned by the taxpayer, enter the roll number or cadastral designation found on their municipal tax bill in box 35. Also, help ensure that box 36 is filled out with the number of owners living in the dwelling, including the taxpayer.

- Enter the spouse's details regarding the dwelling in section B. Read the instructions and fill in boxes 44 and 46 or 50 and 52 if applicable.

Note: Whether the spouse is a tenant or owner, the values must match the taxpayer's information for tenant/subtenant or owner. If entries are made in boxes 32 and 33, boxes 44 and 46 must be filled with the same values. If boxes 35 and 36 are filled in on the taxpayer's return, boxes 50 and 52 must match.

- Make sure you answer all the questions about whether you are eligible in Section A. You can also answer questions about living in a northern village in the next section, above the credit calculations.

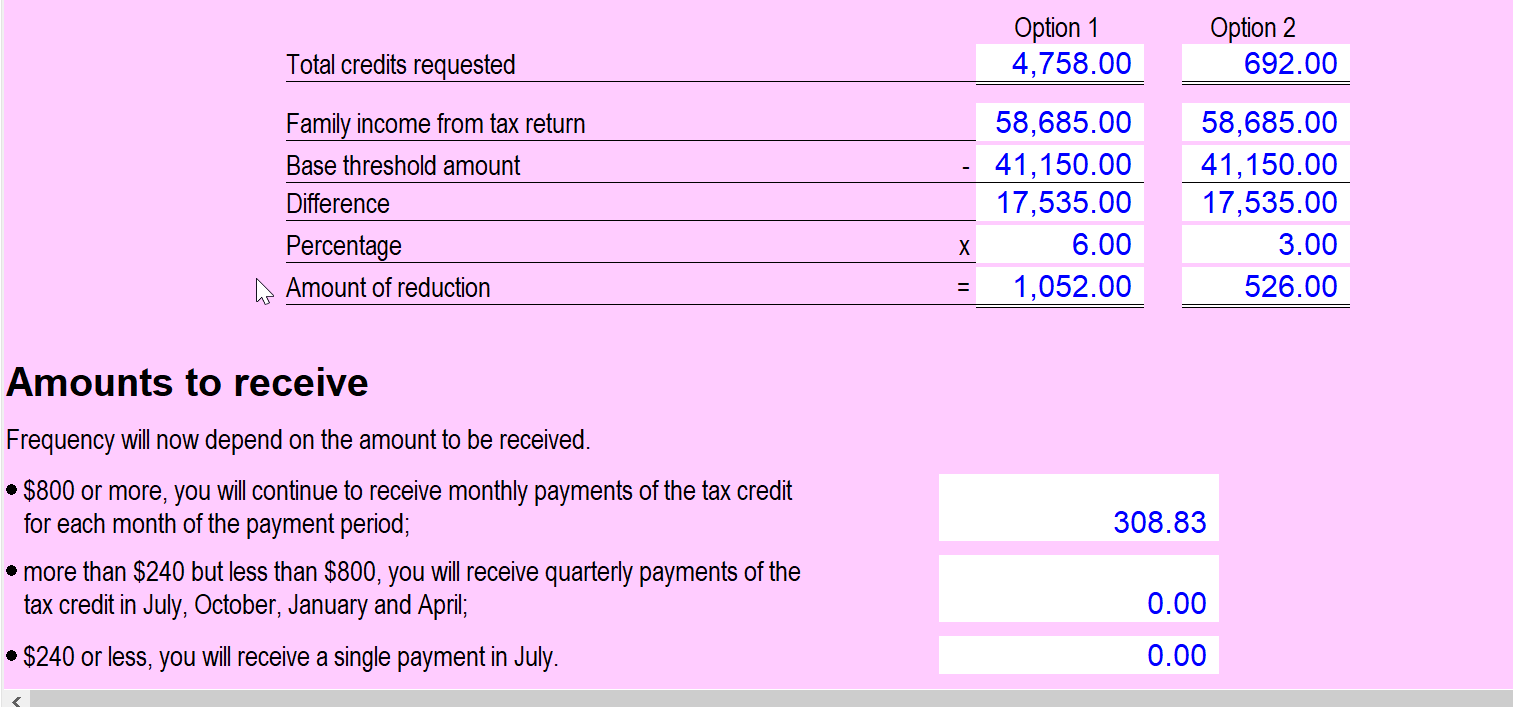

The Amounts to receive section will show you the credits estimated to be issued based on the above calculations. Be advised these are estimates and may change based on calculations by Revenu Québec.

Note: Clients who turn 18 during the tax year and are claiming the solidarity tax credit for the first time must complete the TP1D form online through the Revenu Quebec website.

More like this