Split calculation of business-use-of-home expenses in T1 module

by Intuit• Updated 2 years ago

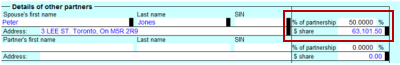

To split calculation of business-use-of-home expenses on a T2125 between spouses, first make sure the partnership is set up correctly. Set the partnership percentage in Details of other partners and not in the Your percentage of the partnership box in the Identification section.

If there is an override in the Your percentage of the partnership box, remove it by clicking in the box and pressing the F2 key.

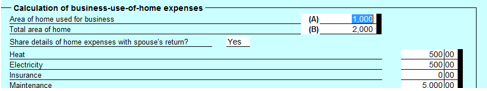

In the Calculation of business-use-of-home expenses box, type Y or Yes in the box Share details of expenses with spouse's return? before entering expenses and then enter the expenses. The expenses will be shared onto the spouse's return.

Note: The option to Share details of home expenses with spouse's return wil not appear on a non-coupled or partnership return..