What does "Limit expenses to commission income" mean?

by Intuit• Updated 2 years ago

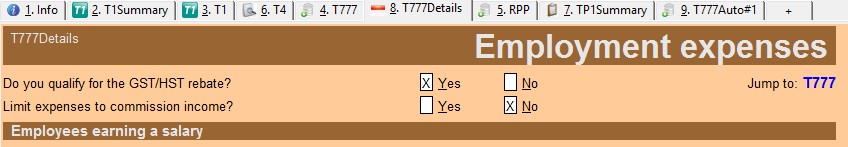

You may have selected Yes to the question Limit expenses to commission income? but the amount from the Commission income section is not going to T777:

Limit expenses to commission income? means Are you claiming employment expenses as a salaried employee or commission employee?

Next steps

If the answer is No, then you are claiming employment expenses as salaried employee and should use amounts from the Salary section of T777 details.

If the answer is Yes, then use the greater of the Commission or Salary sections, as it is more beneficial.

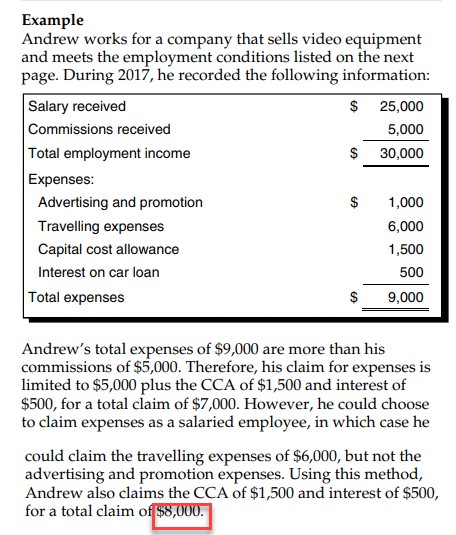

In some cases, the Commission section amount will be greater. In other cases, the Salary section amount will be greater. ProFile puts the higher amount in T777, as per the example in the CRA - T4044 Employment Expenses guide.

Review the Andrew case from the CRA T777 guide:

Sign in now for personalized help

Ask questions, get answers, and join our large community of Profile users.

More like this

- Linking commission income on a T4A to the appropriate T2125 business scheduleby Intuit

- Entering boxes 104, 105, 106, 113, 116, 118, 121, 123, 125, and 127 reported on T5013 slip (T1)by Intuit

- Who can get support for ProFile and whenby Intuit

- Legislation changes to medical expenses - lines 330 and 331by Intuit