T4RIF or T4RSP Transfer in ProFile T1 or Transfer under Section 60(L)

by Intuit• Updated 2 months ago

In ProFile, there are two possible ways to complete a 60(L) copy for a T4RIF or T4RSP. They are based on the age of the recipient. Below are links to each situation:

Scenario 1

A T4RIF or T4RSP is transferred from a deceased spouse and the taxpayer is over 71.

Resolution

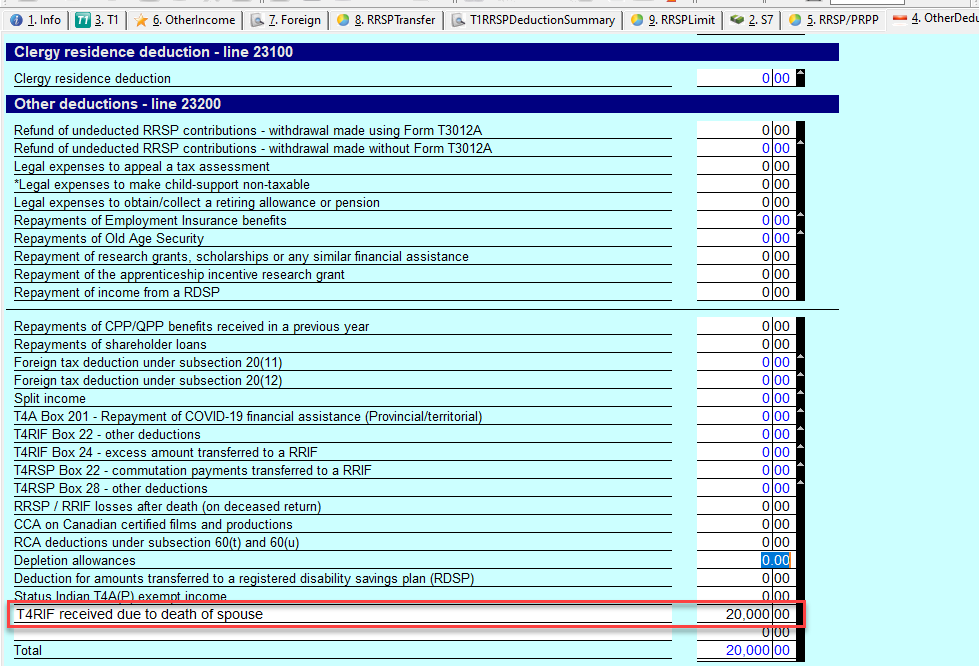

Enter the RIF amount being transferred to spouse on the Other Deductions form under the section for line 23200. This will be a manual entry. This amount will then be deducted from T1 Jacket.

Note: In 2018 and earlier years, line 23200 was known as line 232.

Scenario 2

A T4RIF or T4RSP is transferred from a deceased spouse and the taxpayer is under 72.

Resolution

- Enter the T4RSP information.

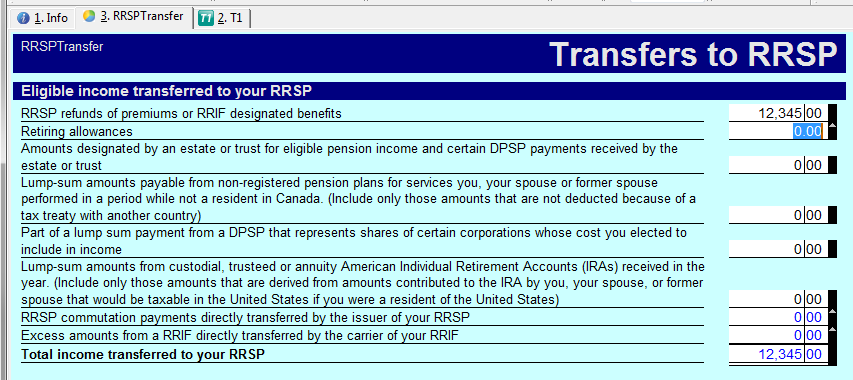

- Open the RRSPTransfer form. Depending on the box number, this may have already been populated.

- If not yet populated, enter the amount to be transferred to the appropriate line.

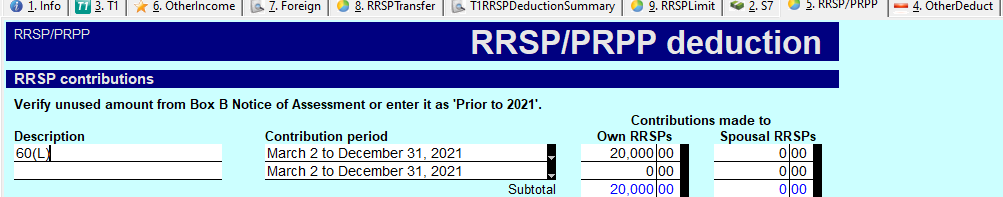

- Open the RRSP worksheet.

- Enter the amount as a contribution (March - December).

Note: Use a description such as Section 60(L) transfer for recordkeeping purposes.

More like this