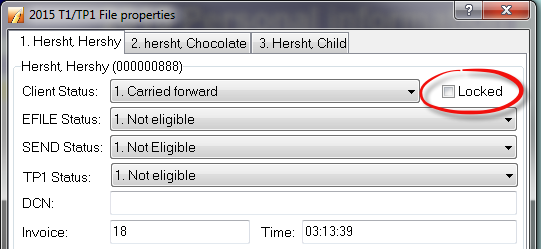

The return may be locked

If tuition is not transferring from dependants, the return may be locked.

1. Select the Properties... option from the File drop-down menu in the top toolbar. The File properties window displays.

2. Unselect the Locked checkbox in the top-right corner if it has been selected.

3. Click the OK button.

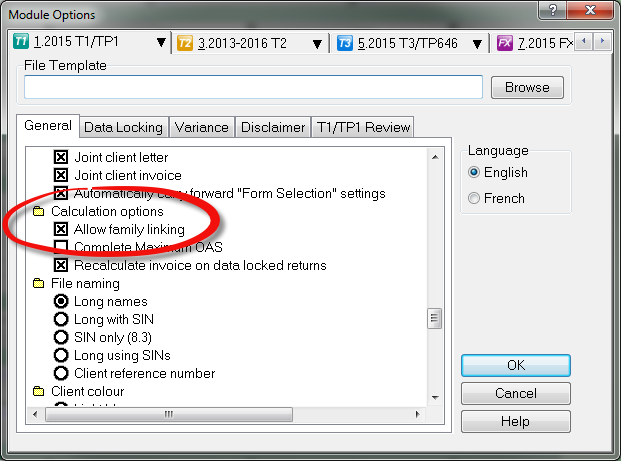

Family linking may be disabled

1. Select Module under the Options drop-down menu in the top toolbar. The Module Options window displays.

2. Ensure the Allow family linking option is enabled under the Calculation options list in the General tab.

3. Click the OK button.

Tax payable amount may not exist

The tuition amount will always be used first by the student to lower their tax payable.

Review the Summary form. If there is no amount in line 420, there is no tax payable amount and the tuition amount will not transfer.