Changing Taxpayer Address in Intuit ProFile T1

by Intuit• Updated 8 months ago

General Steps

- Open the taxpayer's file in Intuit ProFile T1.

- Locate the relevant section for the taxpayer's information.

- Update the address details.

- There isn't a federal, CRA, request address change checkbox

- Help ensure the updated information is correctly reflected in the electronic filing forms.

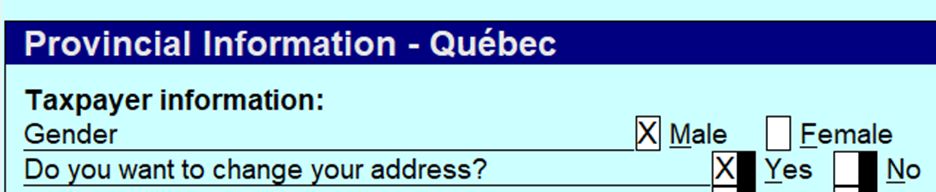

Revenu Québec (MRQ) Request Address Change

- Similar to the CRA, the address update in ProFile T1 should transfer to the MRQ electronic filing forms.

- MRQ will update their records upon receiving the electronically filed TP1 return with the new address if the Do you want to change your address? field is checked yes

Specific Considerations

Canada Revenue Agency (CRA)

- The updated address in ProFile T1 should automatically populate the CRA's electronic filing forms.

- The CRA will update their records based on the information submitted with the electronic return.

Verification

- Review any notices or letters from the agencies for confirmation of the address update.

Important Notes

- Always double-check the accuracy of the new address before transmitting the return.

- CRA verifies that the address and postal code match entries in the Postal Canada database

More like this