Enter filing credentials for FX or T3

by Intuit• Updated 3 months ago

Table of contents:

About Transmitter numbers

A transmitter number beginning with MM is no longer used for FX or T3 transmissions. Instead, a registered Business Number is needed. In some cases, a Rep ID will be needed.

Enter your business number

- Open ProFile.

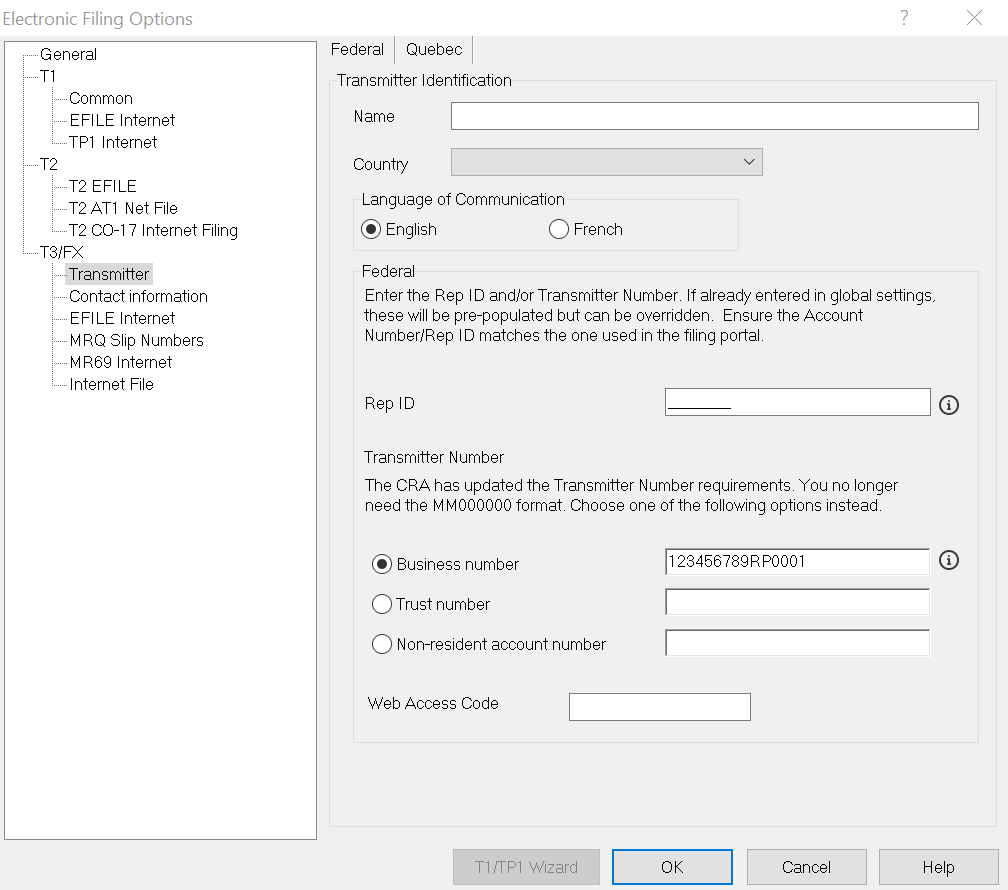

- Select Options... from the EFILE dropdown menu . The Electronic Filing Options window will display.

- Select the Transmitter option under the T3/FX section.

- Enter your 15-digit business number. You'll also want to fill in the Rep ID field if you don't intend to file through ProFile's CRA portal and upload your XMLs to the Represent a Client website.

- You now only need to enter your Web Access Code (WAC) at the CRA portal. There's no need to enter it in the software.

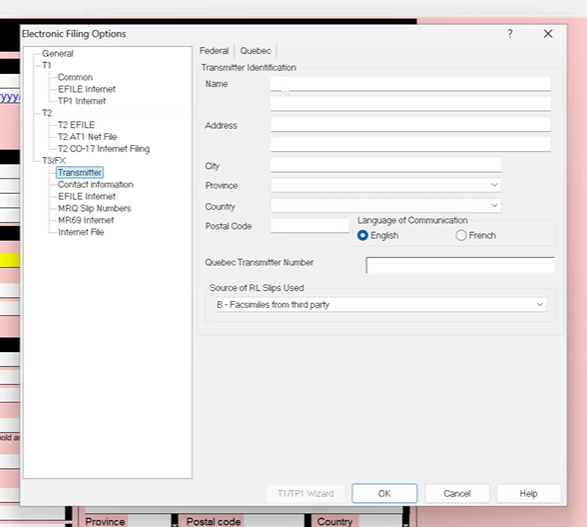

- Select the Quebec tab if you're filing slips and summaries to Revenu Québec, and complete the entries.

- Select OK.

When you build the XML file, the transmitter business number will go to the T619 section. The number must match the number that you will use to login CRA's Internet file transfer application.

Examples of business numbers for purposes of filing

T4A – Payer's Account Number: Required, 15 alphanumeric, 9 digits RP 4 digits, example: 000000000RP0001

T5 – Account Number: Required, 15 alphanumeric, 9 digits RZ 4 digits, example: 000000000RZ0001

T4 – Payroll Account Number: Required, 15 alphanumeric, 9 digits RP 4 digits, example: 000000000RP0001

The business number used for filing should contain 9 numbers, followed by two letters (RP for Payroll Account Number, as an example), followed by four numbers, 0001 (most common), 0002, or 0003.

Notes

- If you file different types of slips, you will need to change the business number in Electronic Filing Options when filing a different slip type than the last.

- You will need a different WAC for each business number of a client. The WAC for a RP filing (T4/T4A) will be different than the WAC for the RZ filing (T5).

When you have entered the business number in the Electronic Filing Options window, you are ready to file slips. See this article for steps on how to file.

Solution to error relating to transmitter not matching account number

If you experience the following error:

"Error: We are unable to process your submission because the transmitter CRA account number given in the attached T619 electronic transmittal record does not match the account number you used to sign in."

And you're filing client T4s through Represent a Client:

- Go to EFILE, then select Options... and select Transmitter, under T3/FX.

- Change Business Number to your Client's CRA Business Number ending in RP000X.

This entry in EFILE Options might be prepopulated with your own Business Number and must be changed to your client's business number (in this case, their Payroll number).

Additional information

For more on CRA's changes for slip filing, see this article.