New filing requirements for taxpayers who electronically sign the T183 in ProFile

by Intuit• Updated 1 month ago

There are new filing requirements for taxpayers electronically signing the T183.

If a taxpayer has electronically signed the T183, you must undertake the following steps:

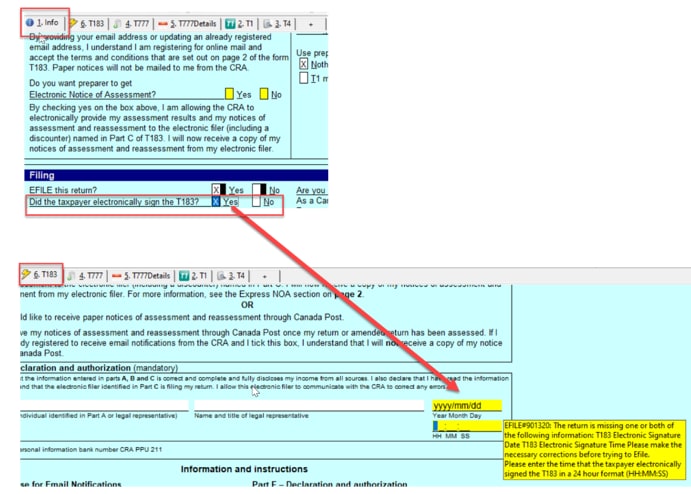

- Select Yes to the question Did the taxpayer electronically sign the T183? In the Filing section on the Info page.

- Navigate to the T183 and complete the Year Month Day field in Part F.

Note: If the fields aren't completed on T183, you won't be able to EFILE, and may encounter the error below upon EFILE:

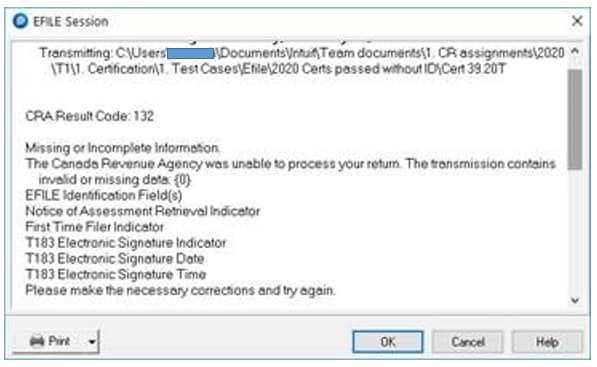

The message reads:

CRA result code 132: Missing or incomplete information. The Canada Revenue Agency was unable to process your return. The transmissions contains invalid or missing data: Notice of Assessment Retrieval Indicator First Time Filer Indicator T183 Electronic Signature Indicator T183 Electronic Signature Date T183 Electronic Signature Time Please make the necessary corrections and try again.

EFILE identification Fields