Data is not being transferred to S1 from S125

by Intuit• Updated 2 years ago

Once a corporation's financial statements have been completed, the corporate tax return from those GIFI amounts can be completed.

Complete a tax return from GIFI

- Navigate to the Info form. An option on the Info form instructs ProFile to transfer amounts from the GIFI statements to other fields in a T2 return.

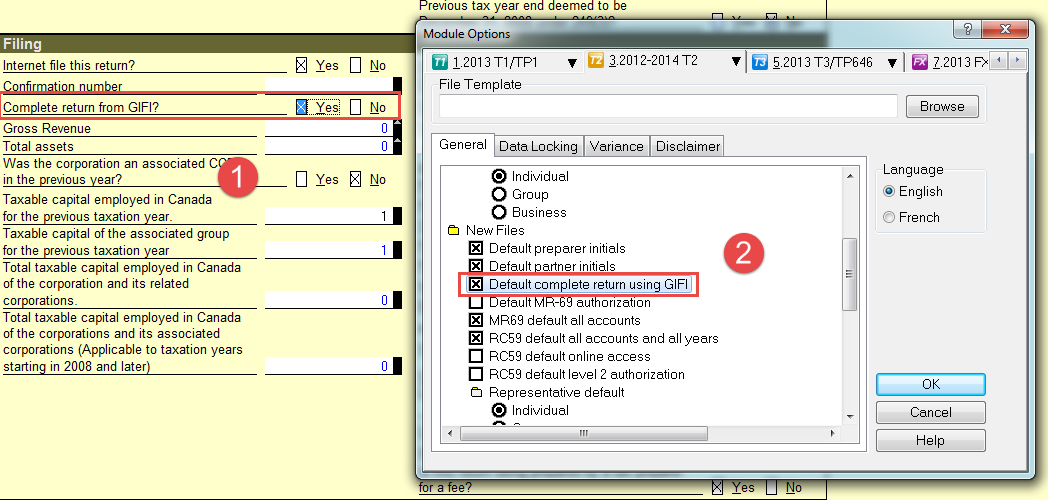

- Identify the query Complete return from GIFI? in the Filing section.

- Select Yes.

Set this option as a default when creating or carrying forward a return

- Select the Module... option under the Options drop-down menu in the top toolbar. The Module Options window displays.

- Select the T2 tab.

- Select the General tab.

- Navigate to the New Files list in the menu.

- Select the Default complete return using GIFI option.

- Click the OK button.

In the case of losses vs. gains, conditions ensure that ProFile only transfers relevant values. If losses are negative values in the GIFI accounts, ProFile converts these to positive amounts for fields that represent a loss as a positive number.

Additional steps

If the above steps fail to resolve the issue, a yellow warning highlight may display in the Summary section of the S1 form.

Check if there is a blank, or second, additional S125 form, and address it accordingly.

More like this

- Import client data for T2 returns directly from the CRA via Auto-Fill My Return in ProFileby Intuit

- Amounts are not appearing in the T2 S125#1 after being imported from GIFIby Intuit

- Warning regarding schedule 1 and schedule 125 on the T2 module in ProFileby Intuit

- Manitoba personal tax credit cannot be claimed in both spouse's tax returnby Intuit