Carry forward other supplier files

by Intuit• Updated 3 months ago

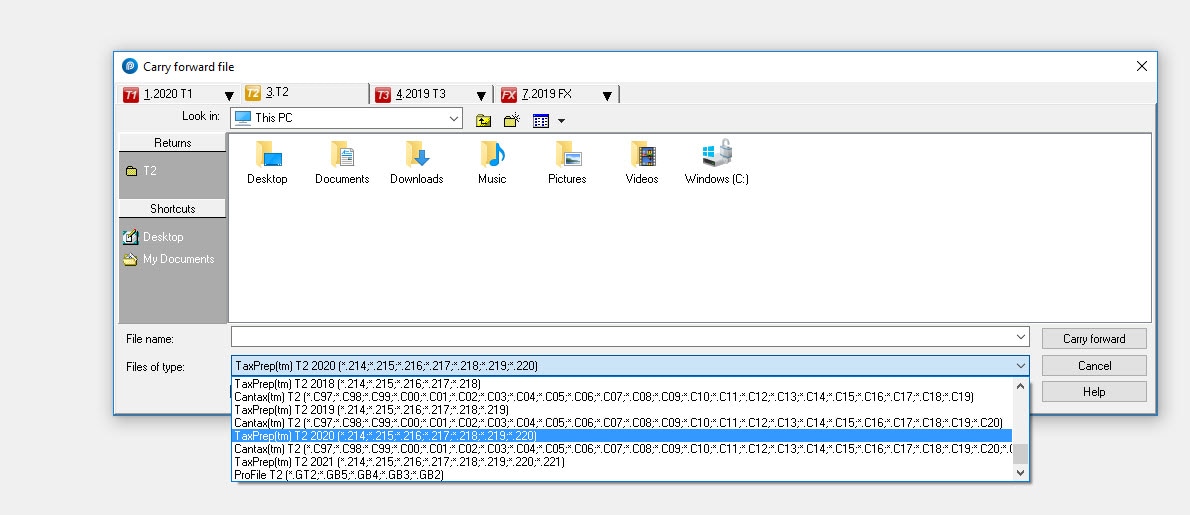

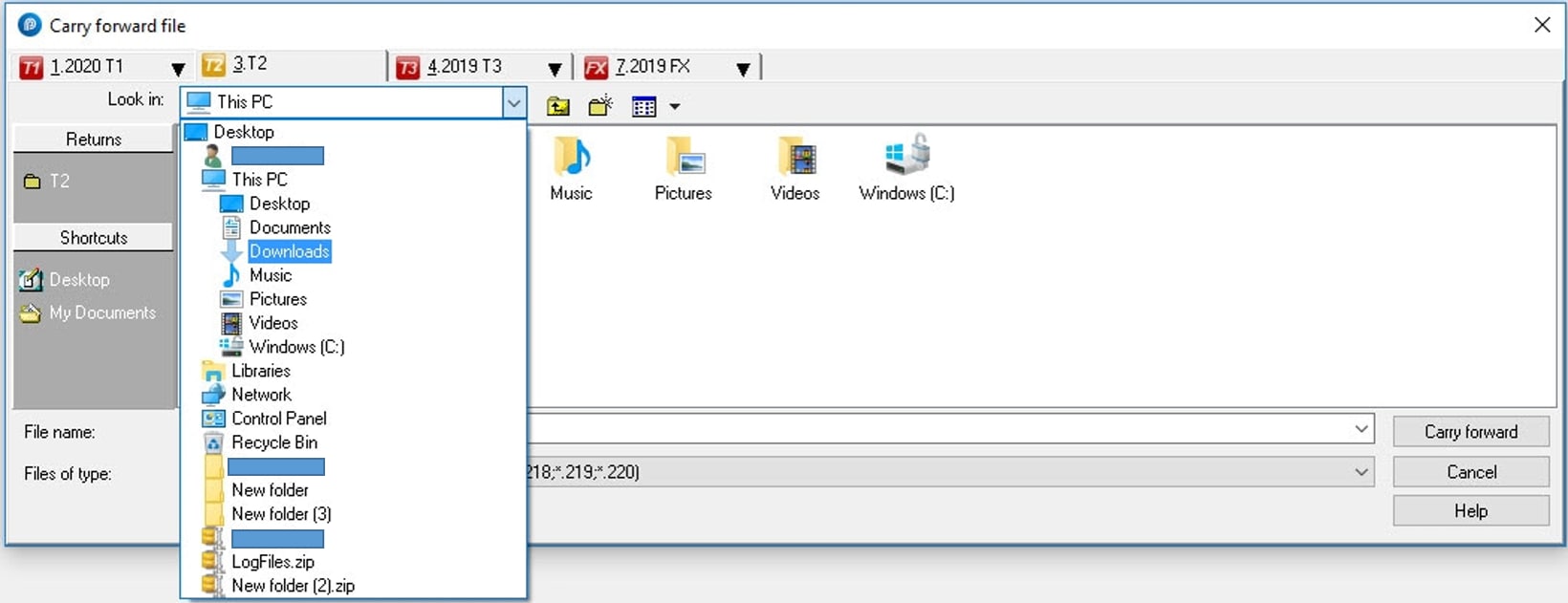

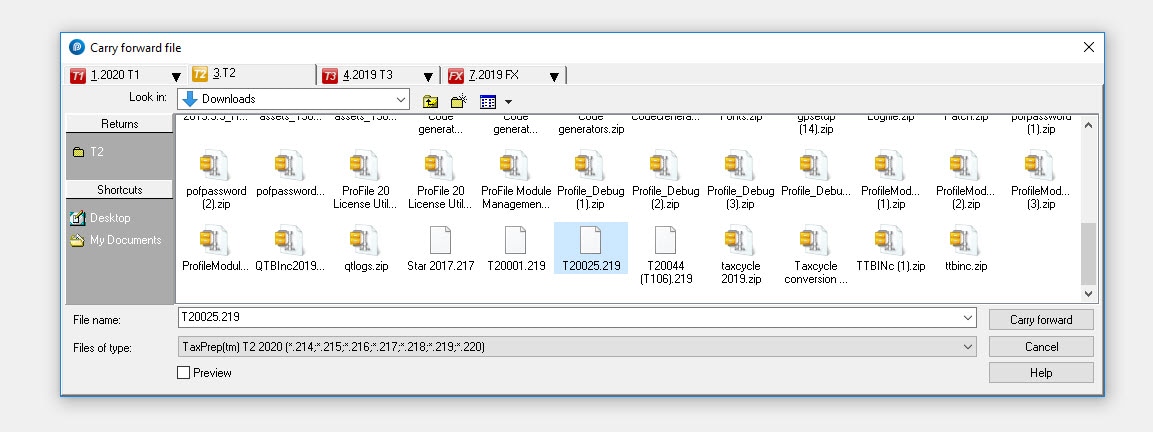

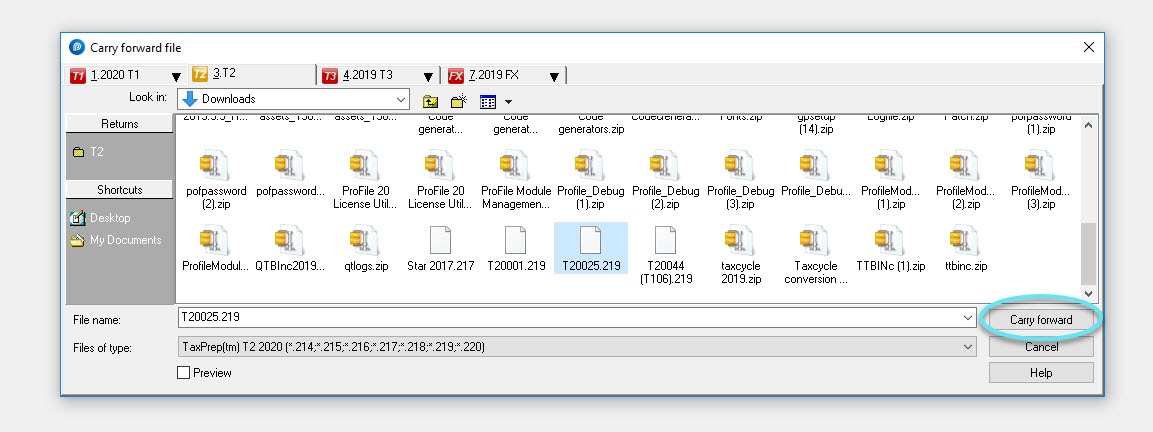

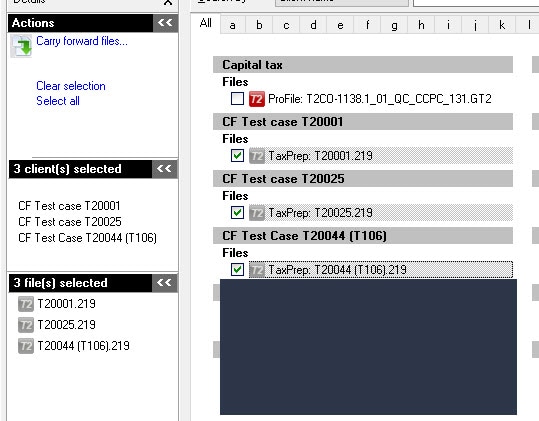

Carry forward refers to the process of advancing a return (or a batch of returns) from the previous year to the next year. Personal information, dependant information, as well as amounts available (for example, tuition, donations, etc.) will carry forward. Importing returns directly into ProFile isn't currently supported.

Note: This article previously used the term competitor carry forward to describe this process.

ProFile allows for the carry forward of other supplier's files, including Cantax, TurboTax, DT Max, TaxCycle and Taxprep tax returns.

| Module | T1/TP1 | T2/CO-17 | T3/TP646 | FX/Q |

| Version (Year) | 2023 | 2023 | 2023 | 2023 |

| ProFile | Y | Y | Y | Y |

| TurboTax desktop | Y | N/A | N/A | N/A |

| TaxPrep | Y | Y | Y | Y |

| CanTax | Y | Y | N/A | Y |

| DT Max | Y | Y | N/A | N/A |

| TaxCycle | Y | Y | N/A | N/A |

Note: ProFile recommends that preparers wait until the fileable release of the ProFile T1 module before carrying forward most files. The first filing release typically has changes to help ensure the smoothest and most complete carry-forward of the previous year's files. For T1, this is the R2 release (for example, 2023.2.0).

| Module | Version Support |

| T1 | Taxprep: Up to version 2024 v5.0 (iFirm is currently not supported.) Cantax: Cantax versions are supported up to 24.5.303.120. TaxCycle: T1 module supports up to version 14.2.57271.0 (files for 2021–2024)DT Max version v28.32: T1 supports tax year from 2017 to 2024 (carry forward of Quebec forms isn't supported for DT Max) TurboTax desktop carry forward for 2024 files will be available with Profile version R1 (2025.1.0) |

| T2 | Taxprep: 2018 V2.0, 2018v2.1, 2019 v1.0, 2020v1.1, 2021v1.0, 2022v1.0, 2022 v2.0, 2022 v2.1, 2023 v1.1, 2024 v1.0, 2025 v1.1 (iFirm is currently not supported.) Cantax: 2018.1.307.100, 2018.2.307.126, 2018.2.307.131, 2019.1.307.100, 2019.2.307.106, 2020.1.307.104, 2021.1.307.100, 22.1.307.100, 23.1.307.100, 24.1.307.100 and 24.1.307.126. TaxCycle version 14.2.57271.0: T2 module supports T2 2016–2024 files. DT Max version 28.31: T2 supports tax year ends from 2019 to 2024. |

| T3 | Taxprep: 2023.v3.0 is the latest version supported. (iFirm is currently not supported.) |

| FX | Taxprep Forms versions up to 2024 v4.0 (iFirm is currently not supported.) Cantax FormMaster versions up to 2024 v4.0. |

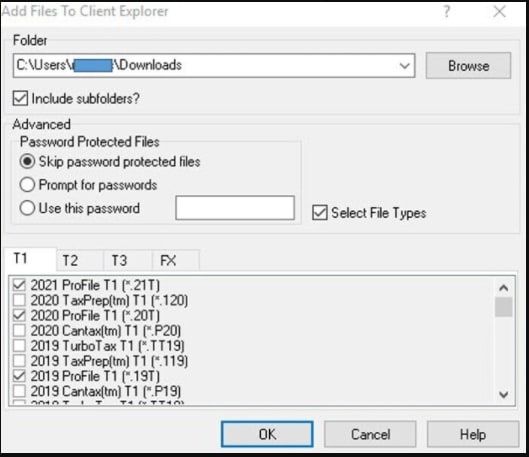

Note: Remove any existing password protection on the other supplier file prior to undertaking carry-forward into ProFile.

Review our dedicated support article for full carry forward details for TaxCycle.

Review our dedicated support article for full details on how to carry forward DTMax files to ProFile.