Enter foreign income pensions on the foreign income page using ProFile

by Intuit• Updated 5 months ago

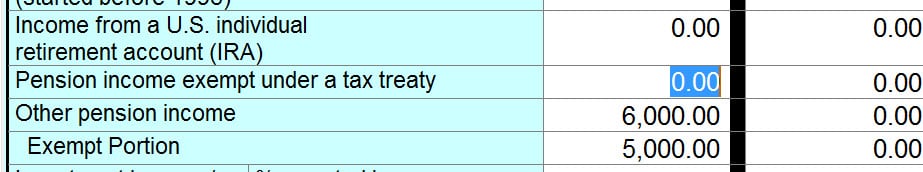

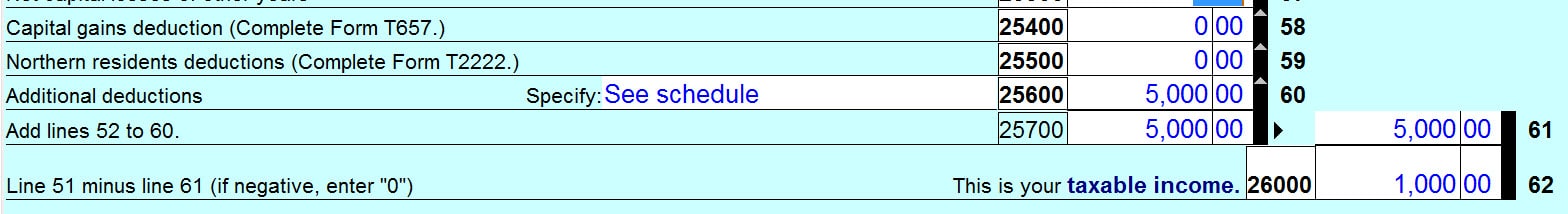

On the Foreign income sheet, there are lines for Pension income exempt under a tax treaty, Other pension income and Exempt portion. If the pension income isn’t entirely exempt from taxation, use the line Other pension income. Use the Exempt portion line if a pension entered on Other pension income is partially exempt.

More like this

- T1 pension splitting and how to split foreign pension and tax on the FTC formby Intuit

- Foreign Tax Credit Form in ProFile: Review and frequently asked questions.by Intuit

- Allocate Trust Income - fixed amounts to beneficiariesby Intuit

- Proration calculations for a non-resident are not prorating properlyby Intuit