- Works across T1 and T2 modules

- Track progress with real time status updates

- Streamline your workflow with full software integration

- Simplify signature requests, collection, and tracking

- Offer clients the modern, easy way to sign

- Ensure client data is safe in the signing process with highly secure encryption technologies

Key Features

Plan, prepare, and file with ProFile

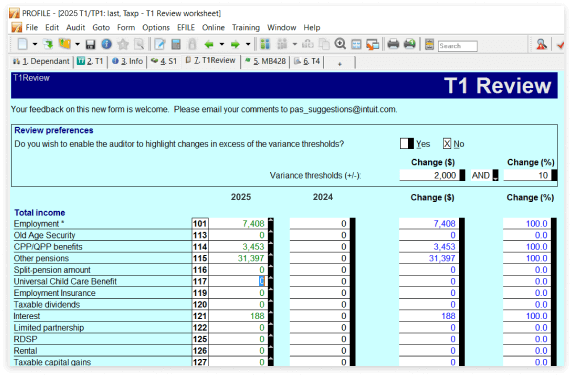

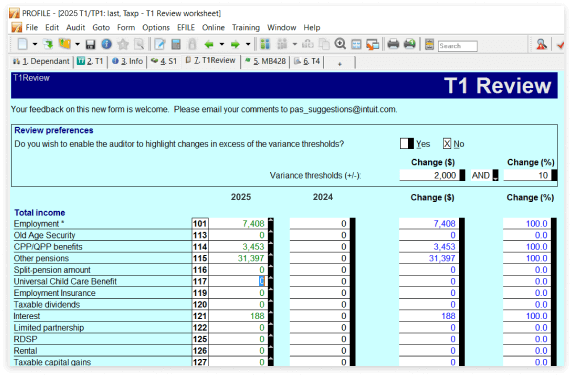

Identify yearly trends

Shorten the review process by monitoring any year-over-year changes with the T1 & TP1 Review Worksheets.

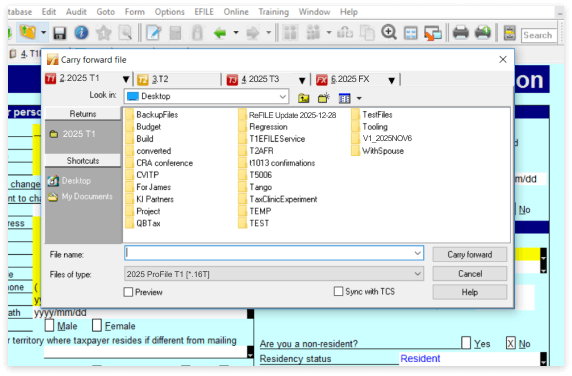

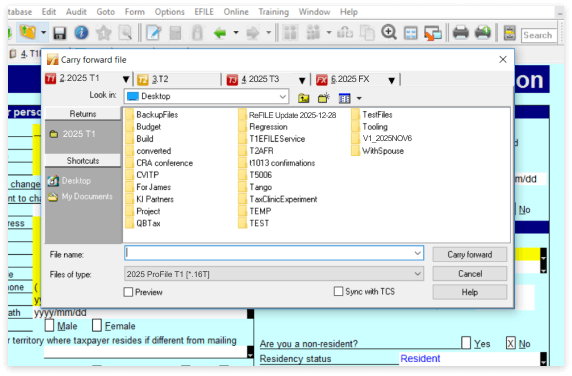

Convert and carry forward files

Ensure your returns are accurate by bringing all the applicable fields and balances from last year with the Carryforward feature.3

You can convert files from:

- TurboTaxTM (T1 only),

- DT MaxTM (T1, T2),

- CantaxTM (T1, T2 & Forms Expert)

- TaxprepTM (all modules)

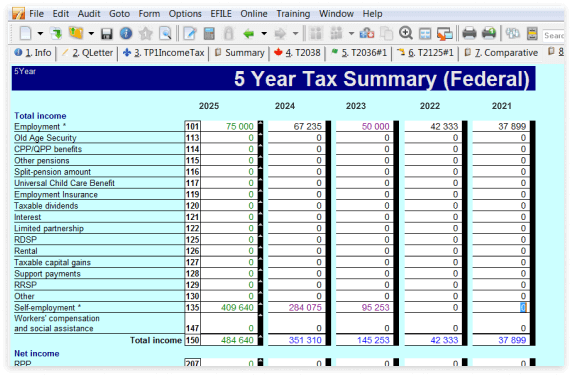

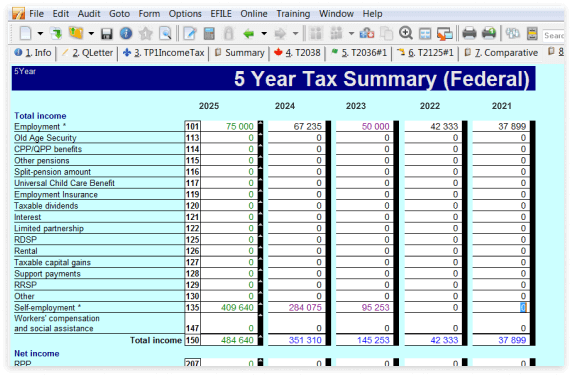

5-Year Tax Summary

Deliver more informed tax advice to your clients by viewing 5 years worth of historical returns while you’re working in a return.

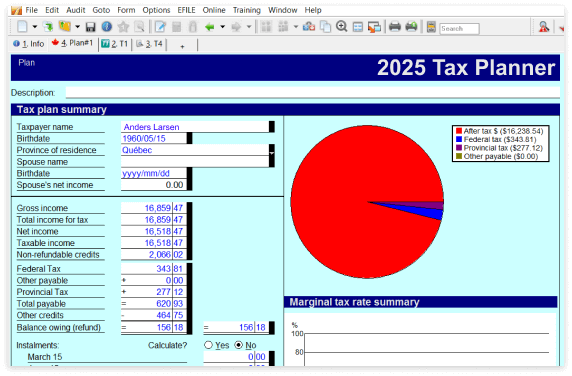

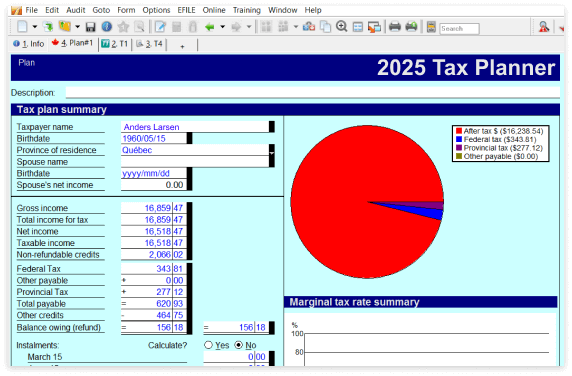

Start planning for next year

The T1/TP1 planner uses next year’s rates to provide a summary of what next year’s tax return will look like.

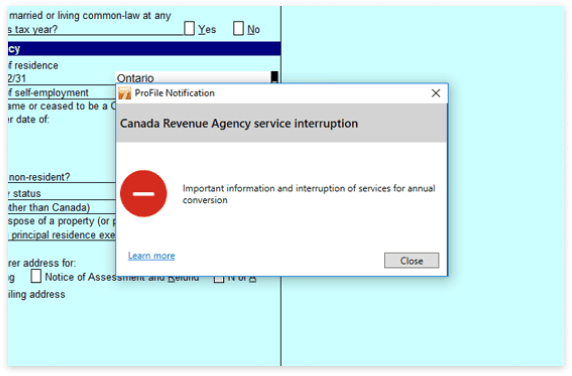

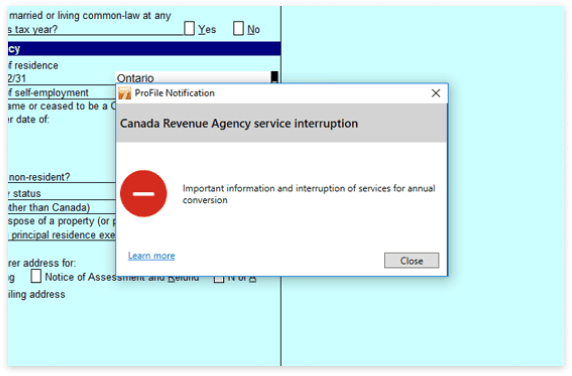

CRA news and notifications

You’re always kept up to date by notifications in the product about the latest CRA news, form amendments, and product updates.

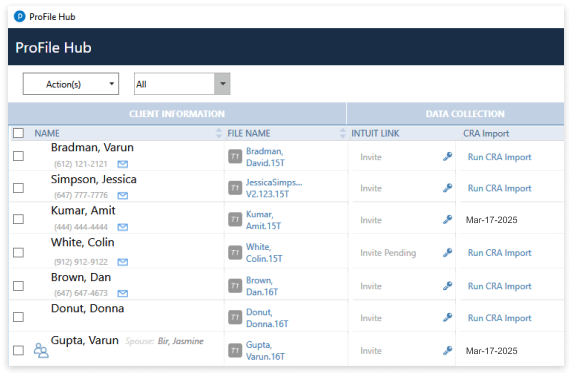

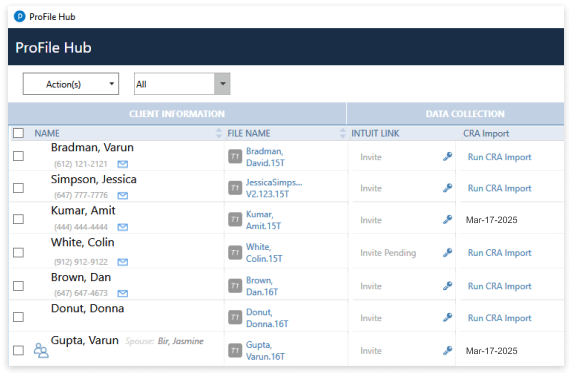

Communicate and collaborate with clients in ProFile

See the status of your client files at a glance using the document management dashboard called Hub.

Then, send personalized requests to clients for missing documents or information using the user-friendly online portal called Link.

Identify yearly trends

Shorten the review process by monitoring any year-over-year changes with the T1 & TP1 Review Worksheets.

Convert and carry forward files

Ensure your returns are accurate by bringing all the applicable fields and balances from last year with the Carryforward feature.3

You can convert files from:

- TurboTaxTM (T1 only),

- DT MaxTM (T1, T2),

- CantaxTM (T1, T2 & Forms Expert)

- TaxprepTM (all modules)

5-Year Tax Summary

Deliver more informed tax advice to your clients by viewing 5 years worth of historical returns while you’re working in a return.

Start planning for next year

The T1/TP1 planner uses next year’s rates to provide a summary of what next year’s tax return will look like.

CRA news and notifications

You’re always kept up to date by notifications in the product about the latest CRA news, form amendments, and product updates.

Communicate and collaborate with clients in ProFile

See the status of your client files at a glance using the document management dashboard called Hub.

Then, send personalized requests to clients for missing documents or information using the user-friendly online portal called Link.

It’s very cost efficient compared to a lot of other software.

More features you’ll love

It’s ease of use, it’s very user friendly, it’s very flexible, and basically it’s more affordable for my clients.

During T1 season, the CRA Import does a lot of the heavy lifting for us. We wouldn’t want to move to something else that doesn’t have the integrations that we do. Intuit’s a one stop shop.