ProFile users can set options that include – but are not limited to – directory settings, preparer information, auditor messages, and more.

Click here to review the process of personalizing ProFile settings.

ProFile users can set options that include – but are not limited to – directory settings, preparer information, auditor messages, and more.

Click here to review the process of personalizing ProFile settings.

ProFile users can assign database settings to make working with multiple returns at one time easier and faster.

Click here to review the process of setting database preferences for Client Explorer.

ProFile users can set print options like assigning a printer, assigning different printers for different forms/slips, setting margins and paper size, print settings by module, and more.

Click here to review the process of personalizing printer settings.

Carry forward is a ProFile service that allows existing client information from previous year’s returns to be “carried forward” into a new return, saving time and effort for tax preparers. ProFile customers can carry forward a return prepared using a competitor’s product.

ProFile users can review the list of which competitors and their versions are eligible to undergo carry forward. This list is updated regularly.

Click here to follow the competitor carry forward process.

Carry forward is a ProFile service that allows existing client information from previous year’s returns to be “carried forward” into a new return, saving time and effort for tax preparers.

ProFile users can carry forward the previous tax year’s ProFile return.

Click here to follow the carry forward process for a previous year.

Carry forward is a ProFile service that allows existing client information from previous year’s returns to be “carried forward” into a new return, saving time and effort for tax preparers.

ProFile users can carry forward multiple returns as a group (or “batch”) by selecting applicable criteria, including tax year, module, and more.

Click here to follow the batch carry forward using Client Explorer.

ProFile is unable to carry forward returns prepared with another software if they have been password protected. The password must be removed from each of the returns before carrying them forward.

Click here to follow the carry forward process for password-protected returns.

ProFile users can carry forward RRSP information from the current and previous year.

Carry forward is undertaken on the RRSP/PRPP form in ProFile.

Note that preparer’s need to source the applicable RRSP slip from their client before carry forward can be undertaken.

Click here to follow the carry forward RRSP process.

Auto-fill my Return (AFR) is a secure CRA service. It allows authorized representatives to electronically request and receive certain tax information to fill in parts of their client's income tax and benefit return.

The tax preparer must have a valid authorization from the taxpayer to access the "Represent a Client" website. There are two ways to acquire this authorization:

Before the T1013 can be filed, the Tax Preparer must register a BN with the “Represent a Client” service.

Click here to follow the AFR for T1 process.

Auto-fill my Return (AFR) is a secure CRA service. It allows authorized representatives to electronically request and receive certain tax information to fill in parts of their client's income tax and benefit return.

ProFile users can review downloaded CRA client data for accuracy and completeness, and then import selected data into a T2 return. This helps verify the client’s tax data against CRA records.

Note that the preparer must file form RC59 and obtain online access for the client’s Business Number. Preparers can also EFILE the RC59 form for authorization.

Click here to follow the AFR for T2 process.

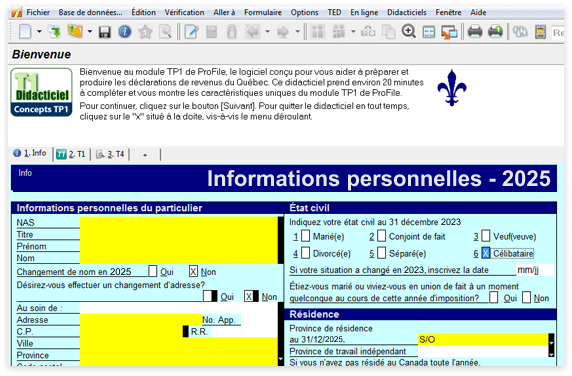

ProFile makes it simple to create a T1 return, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of creating a T1 return.

ProFile makes it simple to create a T2 return, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of creating a T2 return.

ProFile makes it simple to create a T3 return, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of creating a T3 return.

ProFile makes it simple to start in the FX module, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of starting in the FX module.

ProFile users can import multiple T1 returns at one time using Client Explorer. This feature allows preparers to save time, money, and effort.

Users can apply various filters to narrow the import of returns, including tax year, client status, and EFILE status.

Click here to follow the Data Import process in Client Explorer.

By default, the Client Explorer displays all files, regardless of the type of return, taxation year or status. Users can apply filters to display only files that meet the criteria you set.

For example, you may only want to see current T1 files that are ready to EFILE.

Click here to follow the filtering process in Client Explorer.

ProFile users can use the query function to narrow the list to select files for batch printing or to include particular files on a report. Queries can help select data to export, or select files that require mailing labels.

In a query, conditions are set for any field in the client file. The following illustrates two examples:

This requires is a comparison of fields: ProFile filters the client list to display the matching client files.

Click here to follow the queries and reports process for Client Explorer.

Batch filing allows the EFILE multiple of returns at one time, saving time, effort, and money for preparers.

Click here to review the batch filing process in Client Explorer.

Hub is a document management dashboard that helps ProFile users access customer information quickly and seamlessly and process returns more efficiently.

Click here to learn more about Hub and its features.

ProFile makes it easy to file T1 returns electronically.

Click here to follow the single T1 return EFILE process.

ProFile makes it easy to file T2 returns electronically.

Click here to follow the single T2 return EFILE process.

Filing a T3 Trust Return occurs only via paper filing. The “Slips Summary” is eligible for EFILE with slips.

The CRA “T3 Return” guide details where a T3 return is filed:

The CRA “T3 Trust” guide provides information on how to complete the T3 Trust Income Tax and Information Return, the T3 slip, Statement of Trust Income Allocations and Designations, and the T3 Summary, Summary of Trust Income Allocations and Designations:

Click here to follow the single T3 return EFILE process.

ProFile users undertake filing a T3 slip in the same way as slips for a T4 or T5 in the FX module.

Note that T3 trust returns must be paper filed. The Slips Summary undergoes EFILE with the slips.

Click here to follow the T3 slip filing process.

ProFile users can file slips electronically in the FX module.

Two types of slips are filed electronically: original and/or amended.

Click here to follow the FX slip filing process.

ProFile users can set options that include – but are not limited to – directory settings, preparer information, auditor messages, and more.

Click here to review the process of personalizing ProFile settings.

ProFile users can assign database settings to make working with multiple returns at one time easier and faster.

Click here to review the process of setting database preferences for Client Explorer.

ProFile users can set print options like assigning a printer, assigning different printers for different forms/slips, setting margins and paper size, print settings by module, and more.

Click here to review the process of personalizing printer settings.

Carry forward is a ProFile service that allows existing client information from previous year’s returns to be “carried forward” into a new return, saving time and effort for tax preparers. ProFile customers can carry forward a return prepared using a competitor’s product.

ProFile users can review the list of which competitors and their versions are eligible to undergo carry forward. This list is updated regularly.

Click here to follow the competitor carry forward process.

Carry forward is a ProFile service that allows existing client information from previous year’s returns to be “carried forward” into a new return, saving time and effort for tax preparers.

ProFile users can carry forward the previous tax year’s ProFile return.

Click here to follow the carry forward process for a previous year.

Carry forward is a ProFile service that allows existing client information from previous year’s returns to be “carried forward” into a new return, saving time and effort for tax preparers.

ProFile users can carry forward multiple returns as a group (or “batch”) by selecting applicable criteria, including tax year, module, and more.

Click here to follow the batch carry forward using Client Explorer.

ProFile is unable to carry forward returns prepared with another software if they have been password protected. The password must be removed from each of the returns before carrying them forward.

Click here to follow the carry forward process for password-protected returns.

ProFile users can carry forward RRSP information from the current and previous year.

Carry forward is undertaken on the RRSP/PRPP form in ProFile.

Note that preparer’s need to source the applicable RRSP slip from their client before carry forward can be undertaken.

Click here to follow the carry forward RRSP process.

Auto-fill my Return (AFR) is a secure CRA service. It allows authorized representatives to electronically request and receive certain tax information to fill in parts of their client's income tax and benefit return.

The tax preparer must have a valid authorization from the taxpayer to access the "Represent a Client" website. There are two ways to acquire this authorization:

Before the T1013 can be filed, the Tax Preparer must register a BN with the “Represent a Client” service.

Click here to follow the AFR for T1 process.

Auto-fill my Return (AFR) is a secure CRA service. It allows authorized representatives to electronically request and receive certain tax information to fill in parts of their client's income tax and benefit return.

ProFile users can review downloaded CRA client data for accuracy and completeness, and then import selected data into a T2 return. This helps verify the client’s tax data against CRA records.

Note that the preparer must file form RC59 and obtain online access for the client’s Business Number. Preparers can also EFILE the RC59 form for authorization.

Click here to follow the AFR for T2 process.

ProFile makes it simple to create a T1 return, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of creating a T1 return.

ProFile makes it simple to create a T2 return, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of creating a T2 return.

ProFile makes it simple to create a T3 return, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of creating a T3 return.

ProFile makes it simple to start in the FX module, including highlighting mandatory fields and automatically calculating and inserting values into form fields to save preparers time and effort.

Click here to review the process of starting in the FX module.

ProFile users can import multiple T1 returns at one time using Client Explorer. This feature allows preparers to save time, money, and effort.

Users can apply various filters to narrow the import of returns, including tax year, client status, and EFILE status.

Click here to follow the Data Import process in Client Explorer.

By default, the Client Explorer displays all files, regardless of the type of return, taxation year or status. Users can apply filters to display only files that meet the criteria you set.

For example, you may only want to see current T1 files that are ready to EFILE.

Click here to follow the filtering process in Client Explorer.

ProFile users can use the query function to narrow the list to select files for batch printing or to include particular files on a report. Queries can help select data to export, or select files that require mailing labels.

In a query, conditions are set for any field in the client file. The following illustrates two examples:

This requires is a comparison of fields: ProFile filters the client list to display the matching client files.

Click here to follow the queries and reports process for Client Explorer.

Batch filing allows the EFILE multiple of returns at one time, saving time, effort, and money for preparers.

Click here to review the batch filing process in Client Explorer.

Hub is a document management dashboard that helps ProFile users access customer information quickly and seamlessly and process returns more efficiently.

Click here to learn more about Hub and its features.

ProFile makes it easy to file T1 returns electronically.

Click here to follow the single T1 return EFILE process.

ProFile makes it easy to file T2 returns electronically.

Click here to follow the single T2 return EFILE process.

Filing a T3 Trust Return occurs only via paper filing. The “Slips Summary” is eligible for EFILE with slips.

The CRA “T3 Return” guide details where a T3 return is filed:

The CRA “T3 Trust” guide provides information on how to complete the T3 Trust Income Tax and Information Return, the T3 slip, Statement of Trust Income Allocations and Designations, and the T3 Summary, Summary of Trust Income Allocations and Designations:

Click here to follow the single T3 return EFILE process.

ProFile users undertake filing a T3 slip in the same way as slips for a T4 or T5 in the FX module.

Note that T3 trust returns must be paper filed. The Slips Summary undergoes EFILE with the slips.

Click here to follow the T3 slip filing process.

ProFile users can file slips electronically in the FX module.

Two types of slips are filed electronically: original and/or amended.

Click here to follow the FX slip filing process.

Get the help you need directly in-product. Access tutorials from the main menu, select “Training”, then “Tutorials” and choose the tutorial that’s right for your business.

The updated User Guide covers all the basic functions of ProFile in one place. It’s an easy-to-reference PDF that will help get your seasonal hires up to speed.

Have more questions?

Call us toll-free at 1-800-452-9970. Our support hours are Monday-Friday, 9:00 a.m. to 6:00 p.m. EST.

Call sales: 1-844-861-3600