- The automatic expense allocation method minimizes tax for beneficiaries

- Or choose from a variety of methods like equal, percentage, or fixed amount allocation

Key Features

- Switch ProFile between computers using one license at no additional cost

- Simply suspend your licence on your desktop and activate it on a laptop to meet with clients in the field

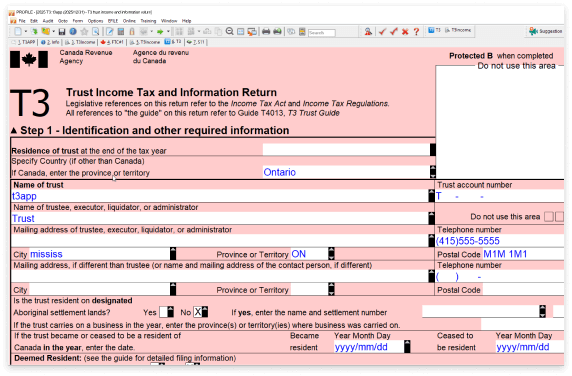

- Over 130 CRA and provincial forms, T3 tax slips and worksheets

- T3 federal, TP-646 Québec, and other special trust returns

- Business, rental and farming statements: T2125, T776 and T2042 tax forms with integrated asset-tracking and CCA calculations

File multiple returns in one session using batch processing

Note: CRA requires EFILE registration

- All prior years are included free

- View multiple returns on one screen

- Access historical returns without having to install anything extra

You’re kept up to date by notifications in ProFile about the latest CRA news, form amendments, and product updates

- Potential errors are highlighted with a yellow background in real-time

- The built-in auditor classifies mistakes by how serious they are for faster reviewing

- Detailed explanations of how to correct the errors means you’re never in the dark

- Manage common tasks for multiple clients in one click and preview details without opening up the return

- Search by client or by situation, create and save custom searches

Save time & optimize trust returns

Flexible enough for all income allocation needs

Don't worry about running through various scenarios and tax calculations. Optimize trust returns with automatic expense allocation or simply select from the various allocation methods to save time. Choose from:

- Automatically allocate expenses

- Equal

- Percentage

- Fixed amount

To be on top of your game, you need ProFile.

More features you’ll love

ProFile's built-in Active Auditor flags errors, omissions, dates & notices – and compiles them into a list with a detailed explanation of how to correct the problem.

Scroll through the list and then jump to the corresponding form and field. View the Auditor as a summary or focus on a specific type of issue (warnings, memos, etc.).

Flag items in the return as you go with Review Marks. Use standard reviewing and editing marks like partner sign-off, correction required, and question mark.

All marks are recorded within ProFile's Active Auditor, for a smoother review process.

Memos are great for adding notes and reminders directly in a tax return. Tapes are handy for making and recording quick calculations in a field.

Review them both using the Active Auditor for a final check.

Attach multiple documents to a form or field of a return using HyperDocs.

Formats include: Excel, Word, PDF, JPEG, and TIFF.

ProFile's built-in Active Auditor flags errors, omissions, dates & notices – and compiles them into a list with a detailed explanation of how to correct the problem.

Scroll through the list and then jump to the corresponding form and field. View the Auditor as a summary or focus on a specific type of issue (warnings, memos, etc.).

Flag items in the return as you go with Review Marks. Use standard reviewing and editing marks like partner sign-off, correction required, and question mark.

All marks are recorded within ProFile's Active Auditor, for a smoother review process.

Memos are great for adding notes and reminders directly in a tax return. Tapes are handy for making and recording quick calculations in a field.

Review them both using the Active Auditor for a final check.

Attach multiple documents to a form or field of a return using HyperDocs.

Formats include: Excel, Word, PDF, JPEG, and TIFF.

- 1: Intuit reserves the right to limit the length of a given call or the number of calls from a given customer.

- Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call sales: 1-844-861-3600