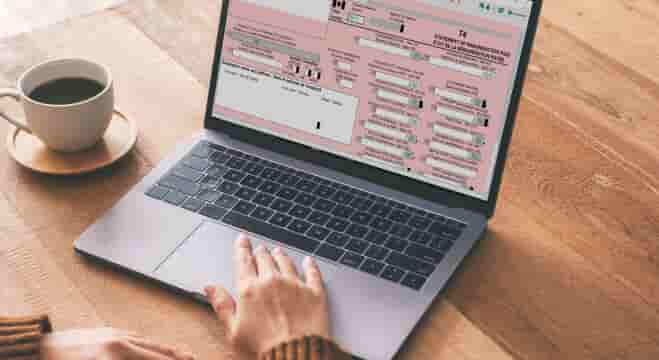

Unlimited electronic filing and preparing of Federal and Quebec information slips, for example, T4/RL1 Statement of Remuneration paid, T4A/RL2 Statement of Pension, Retirement, Annuity, and Other Income; T5/RL3 Statement of Investment Income.

Key Features

Prepare Federal and Quebec information returns such as T5013/TP600 Partnership Information return, T3010/ TP-985.22 Information return for registered charities.

- Switch ProFile between computers using one license at no additional cost

- Simply suspend your licence on your desktop and activate it on a laptop to meet with clients in the field

- Over 130 CRA and provincial forms, T3 tax slips and worksheets

- T3 federal, TP-646 Québec, and other special trust returns

- Business, rental and farming statements: T2125, T776 and T2042 tax forms with integrated asset-tracking and CCA calculations

Eliminate redundant data entry by sharing data between ProFile T1, T2/CO-17 and T3 returns

- Potential errors are highlighted with a yellow background in real-time

- The built-in auditor classifies mistakes by how serious they are for faster reviewing

- Detailed explanations of how to correct the errors means you’re never in the dark

- Manage common tasks for multiple clients in one click and preview details without opening up the return

- Search by client or by situation, create and save custom searches

Eliminate redundant data entry

Once is enough

We understand that T4/T5 are likely not the only returns you file, and having information you’ve included in other returns feed through to the T4/T5 is ideal. To that end, the information from your T1, T2/CO-17, and T3 modules in ProFile will carry across. Less data entry is always a good thing.

Profile is a complete solution for corporate clients that require T4s and T5s.

More features you’ll love

ProFile's built-in Active Auditor flags errors, omissions, dates & notices – and compiles them into a list with a detailed explanation of how to correct the problem.

Scroll through the list and then jump to the corresponding form and field. View the Auditor as a summary or focus on a specific type of issue (warnings, memos, etc.).

Flag items in the return as you go with Review Marks. Use standard reviewing and editing marks like partner sign-off, correction required, and question mark.

All marks are recorded within ProFile's Active Auditor, for a smoother review process.

Memos are great for adding notes and reminders directly in a tax return. Tapes are handy for making and recording quick calculations in a field.

Review them both using the Active Auditor for a final check.

Attach multiple documents to a form or field of a return using HyperDocs.

Formats include: Excel, Word, PDF, JPEG, and TIFF.

ProFile's built-in Active Auditor flags errors, omissions, dates & notices – and compiles them into a list with a detailed explanation of how to correct the problem.

Scroll through the list and then jump to the corresponding form and field. View the Auditor as a summary or focus on a specific type of issue (warnings, memos, etc.).

Flag items in the return as you go with Review Marks. Use standard reviewing and editing marks like partner sign-off, correction required, and question mark.

All marks are recorded within ProFile's Active Auditor, for a smoother review process.

Memos are great for adding notes and reminders directly in a tax return. Tapes are handy for making and recording quick calculations in a field.

Review them both using the Active Auditor for a final check.

Attach multiple documents to a form or field of a return using HyperDocs.

Formats include: Excel, Word, PDF, JPEG, and TIFF.

There isn’t much of anything that we need to get to the CRA that we can’t produce from ProFile.

ProFile has fantastic time saving features.

- 1: Intuit reserves the right to limit the length of a given call or the number of calls from a given customer.

- Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call sales: 1-844-861-3600