- File multiple returns in one session with batch processing

- Simplify your EFILE process with CRA tools built into ProFile:

- Auto-Fill My Return

- ReFILE

- Express Notice of Assessment

- Pre-Authorized Debits

Note: CRA requires EFILE registration

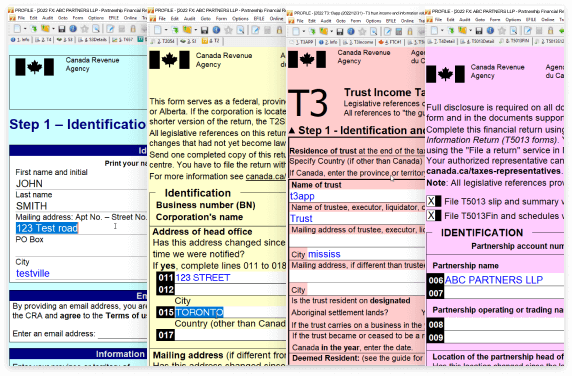

The ProFile Tax Software Suite includes all the modules and features ProFile has to offer for individual, corporate, trust tax returns, and the forms module.

With your ProFile license a single user can prepare an unlimited number of tax returns including:

“To be on top of your game, you need ProFile.”

During T1 season, the CRA Import does a lot of the heavy lifting for us. We wouldn’t want to move to something else that doesn’t have the integrations that we do. Intuit’s a one stop shop.

It’s ease of use, it’s very user friendly, it’s very flexible, and basically it’s more affordable for my clients.